In a surprising move, Andreessen Horowitz, a major venture capital firm from Silicon Valley, is closing its UK office. This decision, reported on January 24, 2025, marks the end of their brief expansion into the UK, which had been highly publicized in 2023 as part of the firm’s big push into global crypto markets.

The Big Picture: What’s Happening?

Andreessen Horowitz (a16z), one of the leading firms in Web3 investment, opened its first office outside the U.S. in London just a year ago. The UK had been pitching itself as the next big crypto hub, with politicians offering new regulations and tax incentives to attract crypto companies. This move seemed like a good bet for a16z, considering the UK government was rolling out policies aimed at fostering innovation in the blockchain and digital asset sectors.

However, despite initial excitement, Andreessen Horowitz is now pulling back. The firm announced it’s closing its London office and shifting focus back to the U.S., where the political climate is changing in favor of the crypto industry under the Trump administration. This shift might be a strategic play to align with regulatory and political changes in the U.S., where there’s been significant progress in creating a more crypto-friendly environment.

Why Did This Happen?

There are several factors behind this move:

- UK’s Tougher Stance on Crypto: While the UK tried to position itself as a global crypto hub, UK regulators have been quite tough on crypto companies. The Financial Conduct Authority (FCA) has implemented strict guidelines, and the UK government has been enforcing more rules, including limitations on crypto promotions. This tough-love stance created friction, even for major players like PayPal and Revolut, which have expressed concerns.

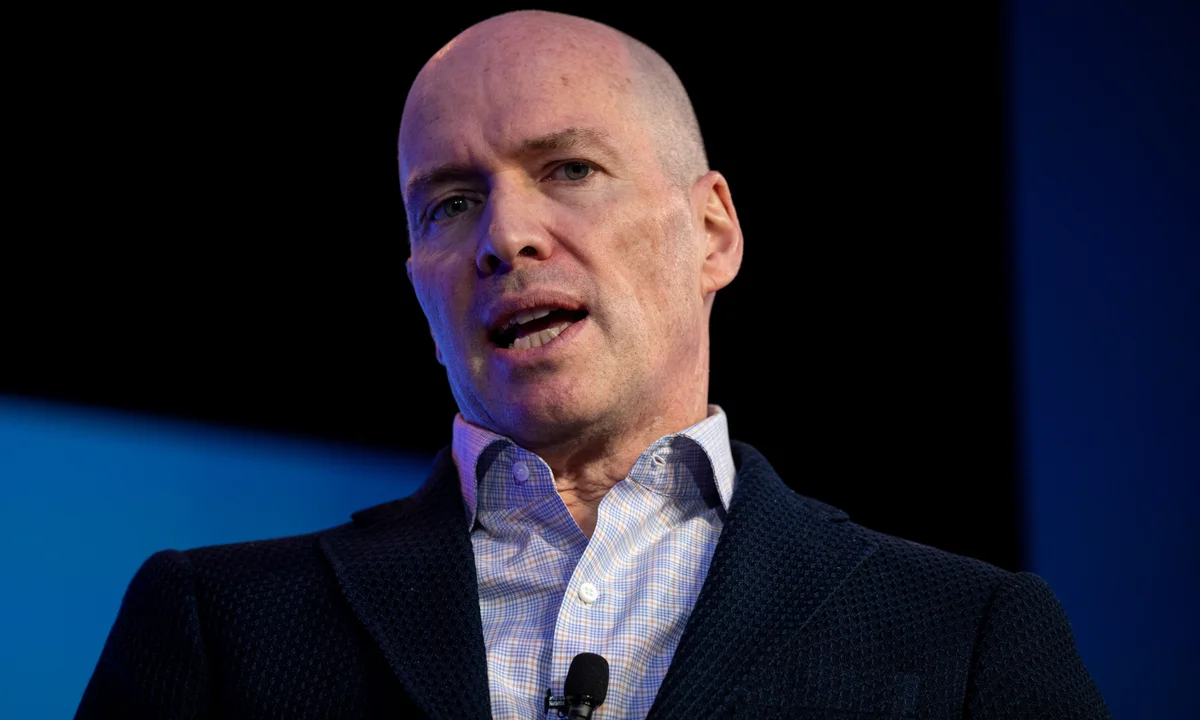

- Political Shifts in the U.S.: A16z’s co-founders, Marc Andreessen and Ben Horowitz, have been vocal supporters of Donald Trump. With the Trump administration settling in, there’s been a shift in U.S. policy that’s more welcoming to the crypto industry. This could explain why the firm is now refocusing its efforts on the U.S. market.

- Investment Strategy and Leadership Changes: The partner leading a16z’s UK efforts, Sriram Krishnan, who had also been involved in Trump’s AI advisory efforts, started pulling back from the UK last year and has since left the firm. This suggests that the firm’s leadership is shifting away from European ventures.

- Growing U.S. Crypto Landscape: Meanwhile, the U.S. is becoming even more dominant in the crypto space, with new laws and regulations supporting blockchain and digital asset companies. As the firm shifts focus to Trump’s America, it signals a growing trust in the evolving regulatory environment there.

Why Should You Care?

This move is important for several reasons:

- Impact on Global Crypto Regulations: The UK’s struggle to balance innovation and regulation reflects a larger global trend. Understanding how different countries handle crypto regulation will help you anticipate where the best opportunities might be for investing, building, or expanding your crypto business.

- U.S. Crypto Dominance: With Andreessen Horowitz doubling down on the U.S., it signals that the U.S. might be solidifying its position as the dominant force in crypto innovation and investment. This is a significant shift you should keep an eye on, as it could influence market trends and investment opportunities.

- Strategic Decision Making in Business: Andreessen’s pullback from the UK also shows how big players make strategic decisions based on changing political climates. Understanding these factors can help you refine your own approach to investing or building businesses, especially if you’re involved in crypto or any tech-related fields.

- What It Means for Investors: If you’re looking to invest in crypto or tech, knowing where firms like Andreessen Horowitz are focusing their energy is key. A move like this could signal growing opportunities in the U.S. and potentially provide insights into where the crypto market is heading.

Key Takeaways:

- A16z’s UK exit signals challenges in the UK’s regulatory environment for crypto.

- The firm’s focus on the U.S. reflects the growing importance of crypto-friendly policies in America.

- Understanding this political shift helps you better navigate the evolving landscape of global crypto regulations.

- This development is crucial for crypto investors and entrepreneurs looking to make informed decisions in a rapidly changing industry.

By understanding why major firms like Andreessen Horowitz are making these moves, you’re positioning yourself to stay ahead in the crypto game, whether as an investor, entrepreneur, or enthusiast.