Hook: A bold stance against the future of money? Trump’s Treasury pick thinks America doesn’t need a central bank digital currency (CBDC). But what does this mean for you and the crypto world?

The Big Idea

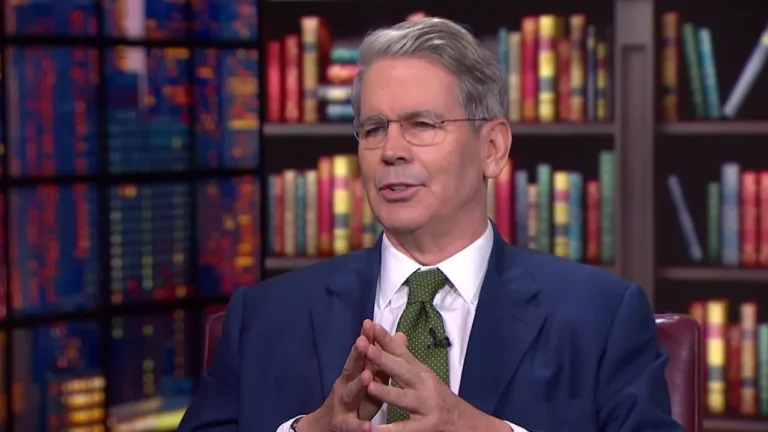

Scott Bessent, Donald Trump’s nominee for Treasury Secretary, believes there’s “no reason” for the U.S. to adopt a central bank digital currency (CBDC). His argument? CBDCs are for countries without solid investment options. In contrast, he suggests the U.S. doesn’t need one because its financial system is already robust.

To put it simply, a CBDC is like digital cash issued by the government. Think of it as an official, government-backed version of cryptocurrency, but with more regulation and control. While some countries are jumping on this trend, Bessent—and many others—are skeptical about its value for the U.S.

Why This Matters

- Government Control: Critics, including some Republican lawmakers, argue that a CBDC could allow the government to monitor every transaction. This sparks concerns about privacy and personal freedom.

- America’s Role in Crypto: As Bessent supports a pro-crypto agenda, his stance could lead to policies that prioritize decentralized cryptocurrencies (like Bitcoin and Ethereum) over a centralized CBDC.

- Global Trends: Over 134 countries are exploring CBDCs, with some already launching them. If the U.S. rejects the idea, it could impact its leadership in global financial innovation.

The Context

The Federal Reserve has been studying the idea of a U.S. CBDC since 2022, weighing its pros and cons. Current Treasury Secretary Janet Yellen has taken a cautious approach, while Fed Chair Jerome Powell has made it clear that Congress would need to approve any CBDC project.

Yet, Bessent’s anti-CBDC stance is a sharp contrast to these efforts. His view is that the U.S. should focus on existing crypto technologies rather than reinventing the wheel with a digital dollar.

What’s Next?

If confirmed, Bessent’s role as Treasury Secretary would be pivotal in shaping U.S. financial policy. Here’s what could happen:

- Pro-Crypto Policies: Expect regulations that encourage innovation in blockchain and cryptocurrencies.

- No CBDC: A likely halt to any push for a U.S. digital dollar, aligning with his belief that it’s unnecessary.

- Global Competition: Without a CBDC, the U.S. may rely on private cryptocurrencies to maintain its financial influence globally.

Key Words to Remember

- CBDC (Central Bank Digital Currency): Digital cash issued and controlled by a government.

- Decentralized Cryptocurrencies: Cryptos like Bitcoin that operate independently of central authorities.

- Regulatory Framework: The rules and policies shaping how crypto is used and developed.

Why This Is Important for You

As someone interested in cryptocurrency, understanding where the U.S. stands on CBDCs is crucial. If America focuses on decentralized crypto instead of a CBDC, it could mean:

- More freedom and innovation in the crypto space.

- A friendlier environment for crypto traders and investors.

- Potential opportunities to profit from policies that boost the crypto market.

But here’s the catch: if other countries adopt CBDCs and the U.S. doesn’t, global trade and finance could shift in ways that affect American dominance.

The Bottom Line

Bessent’s anti-CBDC stance reflects a belief in crypto’s decentralized power. For you, this means keeping an eye on how U.S. policies evolve. If the government leans into crypto-friendly regulations, it could open doors for innovation, trading, and investment. But remember, the global stage is heating up, and what happens next will shape the future of money. Stay informed, stay curious, and watch closely.