Hook:

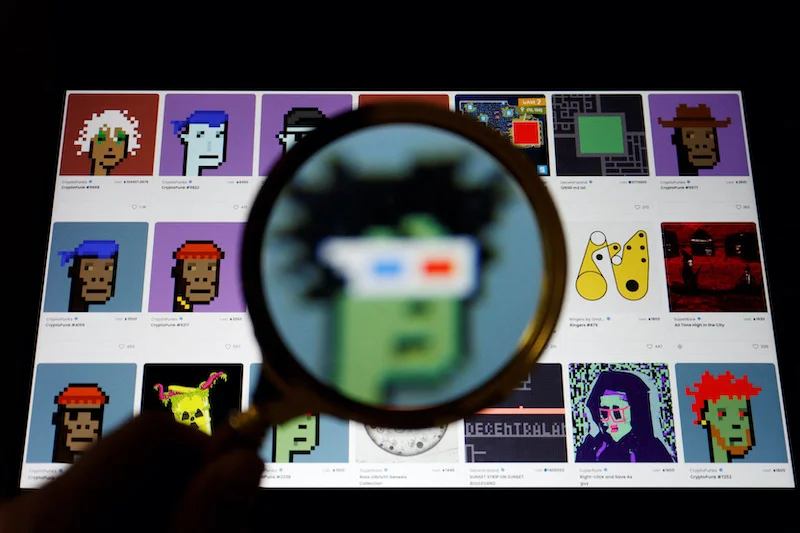

The NFT world, once the crown jewel of Web3 innovation, just faced its toughest year since 2020. What happened, and what does this mean for the future of digital collectibles?

What Happened?

In 2024, the NFT market hit a rough patch. According to DappRadar, trading volume dropped by 19%, falling from $16.8 billion in 2023 to $13.7 billion. It’s the worst performance since the NFT craze began in 2020. Alongside this, the number of NFT sales also dropped by 18%, shrinking from 60.6 million in 2023 to 49.8 million.

But here’s an interesting twist: While sales were down, NFTs became more expensive overall, driven by rising cryptocurrency prices, especially Ethereum.

Key Moments in 2024

- Volatility in Trading Volume:

- Q1: Trading volumes hit $5.3 billion (a small 4% growth compared to Q1 2023).

- Q3: A sharp drop to $1.5 billion—buyers seemed to lose confidence.

- Q4: A slight recovery to $2.6 billion, but not enough to save the year.

- Big Winners and Losers:

- Winners: Pudgy Penguins dominated the market, with a 114% increase in floor price. Their success was driven by creative real-world applications like plush toys in Walmart and gaming partnerships.

- Losers: Yuga Labs, the powerhouse behind collections like Bored Ape Yacht Club, saw declines in trading activity and floor prices. But they’re not out of the game—they’re betting on new innovations in 2025 with their metaverse project, Otherside.

Why Is This Important?

If you’re into NFTs, Web3, or crypto, this article highlights a turning point for the NFT market. It tells us three crucial things:

- The Market is Maturing: The days of hype-driven growth are fading. Buyers are now focusing on value and utility. Pudgy Penguins succeeded because they innovated beyond digital art.

- Volatility Rules the Game: NFT prices and volumes are tied to larger trends in crypto, like Ethereum’s price. As a trader or enthusiast, staying updated on crypto market trends is key.

- Adapt or Fade Away: Projects like Yuga Labs need to innovate or risk losing relevance. This is a lesson for anyone interested in building within the NFT or Web3 space—constant evolution is essential.

Steps to Build Your Knowledge:

- Understand NFT Trends: Look into how collections add real-world applications (like Pudgy Penguins).

- Follow Market Volatility: Learn how crypto prices (like Ethereum) affect NFT values.

- Study Innovation: Watch how major players like Yuga Labs adapt to market challenges.

Key Words to Remember:

- Trading Volume: Total value of NFTs traded.

- Floor Price: The lowest price for an NFT in a collection.

- Volatility: How much and how fast the market changes.

- Utility: Practical applications of NFTs beyond being digital art.

Why It Matters to You:

This isn’t just about NFTs—it’s about the evolution of digital ownership, Web3, and blockchain. By understanding what happened in 2024, you can prepare for future trends and even spot opportunities to invest, create, or trade in this ever-changing space.

The NFT story isn’t over—it’s just getting started.