Hook: The U.S. government says stolen bitcoin from a 2016 mega-hack should return to the crypto exchange it was taken from. But why does this matter to the world of cryptocurrency—and to you?

The Story Behind the Hack

In 2016, Bitfinex, a major cryptocurrency exchange, suffered one of the biggest hacks in crypto history. Over 119,754 bitcoin were stolen, worth about $71 million back then. Fast forward to today, that bitcoin is valued at nearly $4 billion! The heist rocked the crypto world, and it’s been a long road to justice.

The U.S. government recently stated in court documents that the stolen bitcoin should be returned to Bitfinex. This decision aligns with earlier agreements from October 2024, where all parties, including the hackers and Bitfinex, agreed that the exchange was the sole victim.

Who Are the Hackers?

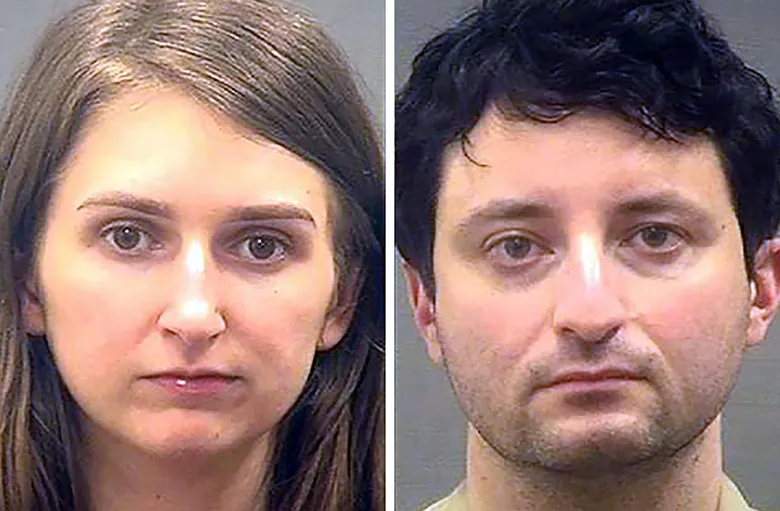

The culprits behind this grand theft are Ilya Lichtenstein and Heather Morgan (a.k.a. “Razzlekhan,” a self-styled rapper). They pleaded guilty to conspiring to launder the stolen bitcoin. Here’s what happened:

- The Hack: In 2016, the pair used advanced hacking techniques to steal bitcoin from Bitfinex wallets.

- Money Laundering: They attempted to “clean” the stolen funds, making them untraceable.

- Caught in 2022: Law enforcement seized about 94,000 bitcoin from their devices, marking the largest asset seizure ever by the U.S. Department of Justice.

Lichtenstein was sentenced to five years in prison, and Morgan received an 18-month sentence.

Why It Matters

This case isn’t just a true crime thriller; it’s a lesson in how crypto security, accountability, and technology shape the industry:

- Victim Restitution: The court is working to ensure Bitfinex and its users recover their funds.

- Crypto Regulation: This case sets a precedent for how stolen digital assets are handled by governments and courts.

- Token Implications: If Bitfinex recovers the bitcoin, it plans to sell 80% of the net funds to repurchase and burn UNUS SED LEO (LEO) tokens. This could reduce the token’s supply, potentially increasing its value.

The Bigger Picture

Understanding this case helps you grasp key issues in the crypto world:

- Cybersecurity Risks: Hacks like this highlight the importance of protecting your crypto assets.

- Legal Precedents: It shows how stolen crypto might be recovered and returned, even years later.

- Market Impact: Recoveries like this can impact token economies (like LEO) and market dynamics.

Steps to Learn and Grow

- Study Crypto Security: Learn about wallets, private keys, and best practices to keep your funds safe.

- Track Legal Cases: Follow high-profile cases to see how they influence crypto laws.

- Understand Tokenomics: Explore how events like token burns or repurchases affect cryptocurrency value.

Key Words to Remember

- Restitution: Returning stolen assets to victims.

- Money Laundering: Hiding the origins of illegally obtained money.

- Token Burn: Reducing the supply of a token to increase its scarcity and potential value.

This case is a powerful reminder of both the risks and the resilience of the crypto industry. By understanding it, you’ll be better prepared to navigate this fascinating world and make smarter, safer decisions in your crypto journey.