Hook:

Ever wondered why giant companies like MicroStrategy pour billions into Bitcoin? Here’s what their latest move means for the crypto world—and why it’s a huge deal.

Breaking Down the Story:

What Happened?

- MicroStrategy’s Big Bitcoin Buy: On December 30 and 31, 2024, MicroStrategy purchased 1,070 Bitcoin for $101 million. They revealed this on January 6, 2025.

- Price Check: They paid about $94,004 per Bitcoin, which is a bold move, considering Bitcoin’s volatile history.

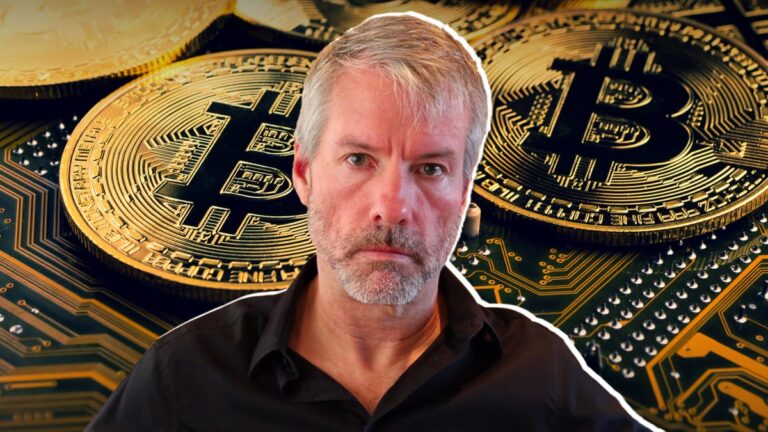

- Hinting at More: Michael Saylor, MicroStrategy’s co-founder, hinted on social media about making even more Bitcoin purchases soon.

What About Metaplanet?

- The Japanese MicroStrategy: Metaplanet, a venture capital firm, aims to boost its Bitcoin stash fivefold to 10,000 BTC by 2025.

- Current Holdings: They already own 1,762 BTC, worth $173.4 million.

- Why It Matters: Metaplanet plans to push Bitcoin adoption in Japan and globally, potentially strengthening Bitcoin’s role in the financial system.

The Bigger Picture:

Both companies are betting big on Bitcoin’s future, anticipating a bull run in 2025 that could send Bitcoin above $200,000.

Why Is This Important?

- Corporate Confidence in Bitcoin:

Companies like MicroStrategy and Metaplanet are treating Bitcoin not just as an asset but as a financial strategy. They’re proving that Bitcoin isn’t just for retail investors—big corporations are also joining the game. - Pioneering the Path for Others:

When giants like these buy Bitcoin, it sends a strong message to the market: Bitcoin is here to stay. This could encourage other firms to follow suit, increasing Bitcoin’s adoption and stability. - Economic Impact:

With Bitcoin’s supply being limited, large-scale purchases by corporations can drive price increases and potentially attract institutional investors, boosting the entire crypto market.

Steps to Understand This Better:

- Study the Key Players: Learn about MicroStrategy, Michael Saylor, and Metaplanet—their strategies and motivations reveal a lot about institutional crypto adoption.

- Follow Bitcoin Trends: Keep an eye on Bitcoin’s price movements, especially leading up to 2025’s predicted bull run.

- Watch for Adoption Signals: Look for signs of increased Bitcoin use in global markets, especially in countries like Japan.

- Understand the Technology: Dive deeper into Bitcoin’s fundamentals, such as limited supply (21 million coins) and why it’s considered a store of value.

Key Words to Remember:

- Bitcoin Treasury: Companies holding Bitcoin as a reserve asset.

- Bull Run: A period of rapid price increases.

- Michael Saylor: A Bitcoin evangelist and co-founder of MicroStrategy.

- Metaplanet: A Japanese company mimicking MicroStrategy’s Bitcoin strategy.

Why You Should Care:

This news is a glimpse into how corporations are shaping the future of cryptocurrency. It shows how Bitcoin is evolving from a speculative asset to a cornerstone of financial strategy for major players. Understanding these moves can help you anticipate market trends and build your knowledge in the crypto space, preparing you for a future where Bitcoin might dominate global finance.

This isn’t just about Bitcoin—it’s about the shifting tides of the financial world.