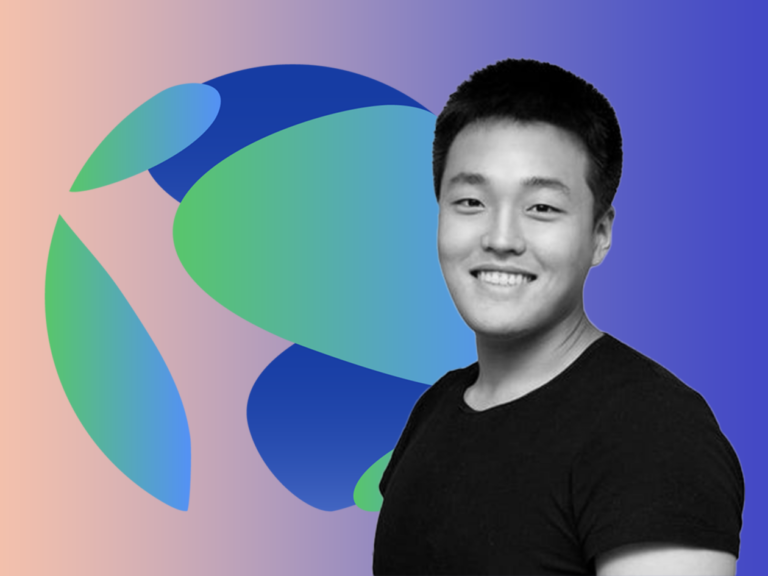

The Hook: A Tech Visionary in Trouble—The Man Behind Terra’s $60 Billion Meltdown Faces 130 Years in Prison

Do Kwon, the co-founder of Terraform Labs, is at the center of a major criminal case after being extradited from Montenegro to the U.S. The charges against him? A shocking mix of fraud, market manipulation, and money laundering—all connected to the spectacular collapse of Terra USD (UST), an algorithmic stablecoin he helped create. The story isn’t just about one man—it’s about a global financial disaster that wiped out billions of dollars. Let’s break down why this case matters, what’s happening in court, and why you need to pay attention.

The Rise and Fall of Terra: A $60 Billion Disaster

In 2022, the cryptocurrency world was rocked when Terra USD (UST) failed. UST was an “algorithmic stablecoin,” which means it used complex algorithms to keep its value stable—something that, in theory, was revolutionary. It was tied to a second token, Luna, to help maintain the value. However, the system failed, and billions of dollars evaporated in an instant. For many, it felt like a tech-driven dream had turned into a nightmare.

The Charges: Fraud, Manipulation, and Lies

Kwon is facing multiple criminal charges in the U.S., including:

- Conspiracy to defraud

- Commodities fraud

- Wire fraud

- Securities fraud

- Market manipulation

- Money laundering conspiracy

Prosecutors claim Kwon built a “financial world” that was nothing more than an illusion—a deceptive network that misled investors, users, and even regulators about the true workings of Terra and UST. Behind the scenes, Terraform’s core products weren’t functioning as promised, and Kwon allegedly used manipulation to trick the world into thinking the system was sound.

The case is massive, not just because of the charges but because of the potential consequences—Kwon faces up to 130 years in prison if convicted on all counts.

Extradition Drama: From Montenegro to Manhattan

Kwon’s extradition to the U.S. has been a subject of global debate. For months, there was uncertainty about whether he would face charges in South Korea (his home country) or the United States. In the end, Montenegro decided to hand him over, and Kwon arrived in the U.S. to face the music. When he entered the Manhattan court, he seemed calm, even smiling as he chatted with his lawyers, though the charges are far from a joke.

Why This Case Matters to You

- The Impact on Crypto Regulation: The collapse of Terra USD shook the entire crypto world and raised serious questions about the regulation of stablecoins and other crypto assets. If Kwon is convicted, it could set important legal precedents for the entire industry.

- The Future of Algorithmic Stablecoins: Terraform’s failure puts a huge question mark over the future of algorithmic stablecoins. The case highlights the risks in using complex algorithms to maintain stability, making it a key learning moment for anyone interested in crypto or blockchain technology.

- Trust in the Crypto Space: At the heart of this case is the issue of trust. Investors put their faith in Kwon’s system, and it collapsed. This story teaches a tough lesson about the importance of transparency and accountability in crypto projects.

Steps You Should Take to Stay Informed

- Follow the trial updates: Kwon’s next court date is January 8. Pay attention to how the trial unfolds—it’s a case that could shape the future of crypto regulations.

- Understand algorithmic stablecoins: If you’re into cryptocurrency, it’s crucial to understand how these systems work and the risks involved. Terra’s failure shows the dangers of relying on untested or unstable financial systems.

- Stay aware of legal developments: Whether you’re an investor or a developer in the crypto space, legal cases like these are bound to influence future regulations and business practices.

Key Terms to Remember:

- Algorithmic Stablecoin: A type of cryptocurrency designed to maintain a stable value through algorithms, rather than being backed by assets like traditional stablecoins (e.g., USDT).

- Market Manipulation: The act of artificially influencing the price or value of a market asset to create a false impression of its worth.

- Money Laundering: The process of making illegal gains appear legitimate.

Why It’s Crucial to Stay Informed

The story of Do Kwon and the collapse of Terra is far from over. The outcomes of this case could have far-reaching implications on crypto regulations, investors’ rights, and the future of digital currencies. Understanding the legal landscape and learning from such high-profile failures can help you navigate the crypto space more wisely, whether you’re looking to invest, build, or simply stay informed.