In a major move shaking up the DeFi (Decentralized Finance) space, World Liberty Financial (WLFI), a project backed by Donald Trump, is joining forces with Ethena Labs for a long-term collaboration. The initial step in this partnership will see the integration of Ethena’s innovative token, sUSDe, into the WLFI platform.

What’s Happening?

World Liberty Financial, a relatively new DeFi platform that’s been making waves since its launch, is looking to introduce Ethena’s yield-bearing token, sUSDe, as the first new collateral asset on its platform. This move is expected to boost liquidity and attract more users to WLFI, especially as it taps into the large community and Total Value Locked (TVL) that Ethena’s platform already commands.

WLFI is expected to make a decision on whether to proceed with this integration by the end of the week. If the governance body gives the green light, sUSDe will become an official collateral option in WLFI’s Aave instance—a decentralized lending protocol that allows users to borrow and lend assets. If not, WLFI and Ethena will continue to explore other ways to collaborate.

Why Is This Important?

- Token Innovation: The integration of sUSDe, a token that’s already gaining momentum on platforms like Aave, represents a significant shift. It’s a yield-bearing token, meaning it can generate returns for its holders. This could bring new investment opportunities, especially for users looking for more ways to grow their holdings within the DeFi ecosystem.

- DeFi Expansion: The collaboration between WLFI and Ethena is part of a larger trend of established DeFi players joining forces. WLFI’s partnership with Ethena—who’s already proven success in the market—signals that the project is on a serious growth path. This could open up more doors for users worldwide to access decentralized financial services with fewer barriers.

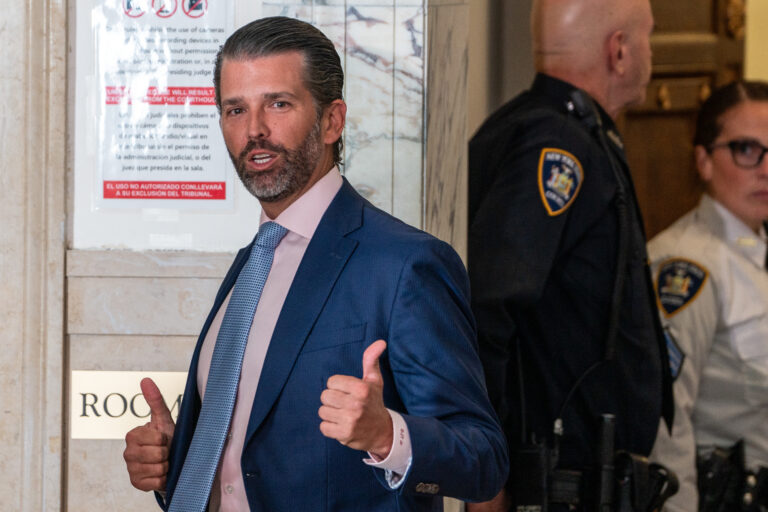

- Strong Backing: The fact that WLFI is backed by high-profile figures, including former president Donald Trump and crypto mogul Justin Sun (founder of Tron), gives the platform credibility and visibility. This could lead to increased trust and adoption among users and investors who may have been hesitant to get involved with newer DeFi projects.

- Strategic Token Purchases: Recently, WLFI purchased $600,000 worth of Ethena’s ENA tokens, signaling a long-term belief in the success of Ethena’s network. This also suggests that the collaboration could evolve into something even bigger in the future.

- Stablecoin Growth: By adding sUSDe to the WLFI platform, the collaboration will likely increase the supply of stablecoins like USDC and USDT on WLFI’s Aave instance. This is crucial because stablecoins play a vital role in DeFi, acting as a bridge between the crypto world and traditional finance.

What Should You Take Away?

For you, this is an exciting development because it shows how DeFi is evolving with strategic partnerships, new token integrations, and high-profile backers. This collaboration could influence the future of decentralized finance, making it more accessible and profitable for everyday users. If you’re interested in cryptocurrency and the future of finance, understanding these partnerships and their impact on the market will help you stay ahead of the curve.

Key Words to Remember:

- DeFi (Decentralized Finance): A sector within crypto that focuses on eliminating intermediaries like banks in financial transactions.

- sUSDe: A yield-bearing token that offers returns to holders, currently growing in popularity.

- Aave: A decentralized lending protocol where users can borrow and lend assets.

- Collateral: Assets used as security to back a loan or borrowing.

- TVL (Total Value Locked): The total amount of capital locked in a DeFi protocol, often used as a measure of the protocol’s success.

- Stablecoins: Cryptocurrencies pegged to traditional assets like the US Dollar, providing stability in volatile markets.

This partnership between WLFI and Ethena might just be the beginning of a wave of new opportunities in the crypto world. It’s important to stay updated on these trends because they could shape the financial landscape in the years to come.