The world of cryptocurrency is buzzing, and this time, it’s all about Ether (ETH). Analysts are predicting that Ether could skyrocket to $4,000 before January 20, 2025, when President-elect Donald Trump is sworn in. So, what’s fueling this excitement, and why should you care about it?

The Growing Power of Ether Over Bitcoin

While Bitcoin (BTC) has been the go-to for many crypto investors, Ether is now stealing the spotlight. It has outperformed Bitcoin in a key area: futures yields. Futures are financial contracts that allow investors to speculate on the future price of a crypto asset, and Ether’s futures contracts have been outpacing Bitcoin’s. Currently, there’s more money invested in Ether futures than Bitcoin—$8.9 billion in Ether versus $6.7 billion in Bitcoin. This shift is a signal that more investors are betting on Ether’s price going up.

This is a big deal because futures trading is often seen as a reflection of institutional interest. Institutions—like big banks or investment firms—tend to have a big impact on crypto prices. And with Ether’s growing presence in the futures market, it could indicate that larger financial players are moving in, which could drive the price higher.

Key Reasons for the Surge

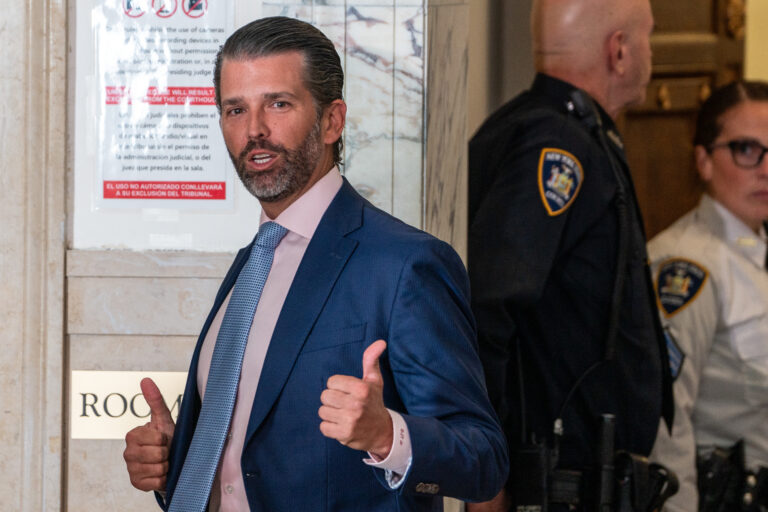

- Regulation Changes: Investors are excited about the possibility of positive changes in crypto regulations as 2025 approaches. The U.S. Securities and Exchange Commission (SEC) Chair, Gary Gensler, is stepping down on January 20, which many believe could lead to a more crypto-friendly environment. With Trump taking office around the same time, analysts are predicting that this could lead to increased confidence in Ether, causing its price to rise.

- Institutional Inflows: Another important factor is the growing demand for Ether Exchange-Traded Funds (ETFs). ETFs allow investors to trade cryptocurrencies like stocks, and they’ve been seeing increased interest, especially from institutions. In fact, Ether ETFs have already been on a winning streak, amassing over $90 million worth of Ether in just a few days. This surge in demand is helping push Ether closer to the $4,000 mark.

- Increased Buzz Around Ether: The hype around Ether is growing in other ways too. Social media platforms like X (formerly Twitter) have seen a huge jump in mentions of Ether, with a 282% increase in posts about it. This shows that public interest is rising, and when more people are talking about an asset, its value tends to go up.

Why This Matters to You

As a 20-year-old interested in cryptocurrency, understanding these trends is key to building your knowledge and staying ahead of the curve. The crypto market is full of opportunities, but it can also be volatile and unpredictable. By learning about how market forces, like futures trading and ETF inflows, impact Ether’s price, you can make more informed decisions when it comes to investing or trading.

Ether’s potential to hit $4,000 is a reminder of how quickly the crypto landscape can change. The market is influenced by many factors, including regulations, institutional investment, and public sentiment. By keeping an eye on these dynamics, you’ll be better prepared for the next wave of growth in the cryptocurrency world.

Key Terms to Remember:

- Futures Trading: Contracts that allow investors to speculate on the future price of an asset.

- Institutional Inflows: Large investments from big financial institutions, which can significantly impact asset prices.

- ETFs (Exchange-Traded Funds): Investment funds that allow people to trade cryptocurrency as they would stocks.

- Regulation Changes: Adjustments in laws or policies that can make crypto markets more favorable or stable.

Understanding these concepts now can help you make smarter choices and tap into the growing world of cryptocurrencies. Ether’s rise isn’t just a trend—it’s a signal that the market is maturing, and it’s something you’ll want to pay attention to if you’re serious about building your knowledge and investments in crypto.