Hook: SEC’s Unprecedented Fines and Global Crypto Regulations Are Changing the Game—Here’s Why You Should Care

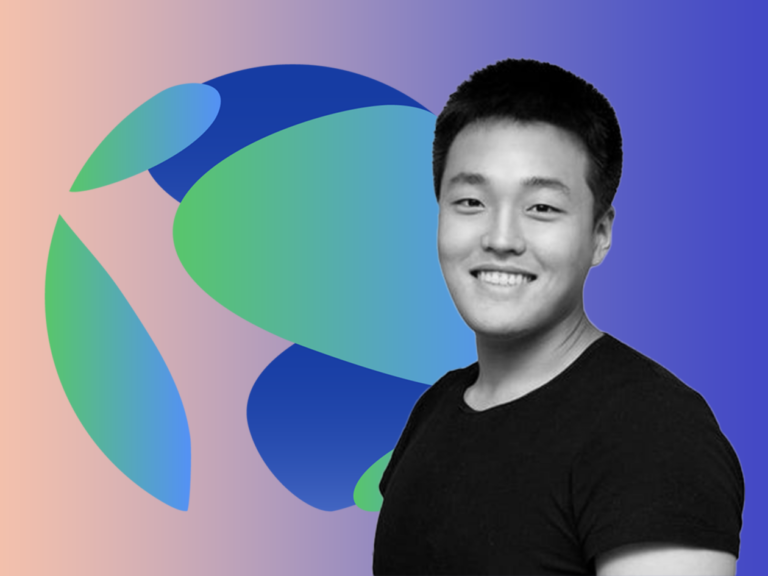

The world of cryptocurrency is no longer just about trading and investing; it’s now a battleground for legal action, penalties, and regulation. The United States Securities and Exchange Commission (SEC) just set a jaw-dropping record in fiscal penalties, with a total of $8.2 billion in fines. This massive amount is largely due to its fight with Terraform Labs, the crypto company behind the infamous TerraUSD collapse. Terraform Labs and its CEO, Do Kwon, were hit with a $4.47 billion settlement, marking the largest penalty in SEC history.

What Happened with Terraform Labs?

Terraform Labs became notorious for its algorithmic stablecoin, TerraUSD, which collapsed in May 2022, causing a ripple effect across the crypto market. The SEC took legal action against the company and its CEO, accusing them of fraud and misleading investors. As a result, Terraform was forced to pay a record $4.47 billion settlement. This settlement made up more than half of the SEC’s $8.2 billion in total fines for fiscal 2024, but without it, the SEC would have only collected $3.72 billion, the lowest since 2013.

Why Should You Care?

This is big news because it shows just how serious regulators are getting about the crypto space. The SEC is now cracking down on companies that don’t follow the rules, and it’s hitting them where it hurts—financially. This also sets a precedent for future cases, meaning if you’re involved in the crypto industry, you need to be extra careful about how you operate. Understanding this crackdown helps you avoid becoming the next target and prepares you for how the landscape is shifting.

Australia Takes a Step Toward Crypto Regulation

Meanwhile, Australia is looking to tighten its grip on crypto through taxation. The country’s Treasury Department is consulting on adopting the OECD’s Crypto-Asset Reporting Framework (CARF). The OECD wants to standardize tax data collection for crypto transactions across borders, which means tax authorities around the world will have better access to data about who’s buying, selling, and trading digital assets. This could lead to stricter reporting requirements for crypto businesses and investors alike.

What’s the Big Picture?

Why is this important for you? As more governments around the world, like Australia, start to put stricter regulations in place, compliance will become even more crucial. Whether you’re investing, developing crypto projects, or simply holding digital assets, understanding taxation and regulatory frameworks will be key to avoiding legal trouble.

Key Takeaways:

- SEC Record Fines: The SEC’s $8.2 billion in penalties, mostly from Terraform Labs, shows just how intense crypto regulations are becoming in the U.S.

- Tax Framework in Australia: Countries like Australia are working to implement global standards for tracking crypto transactions, meaning stricter tax rules are on the horizon.

- Legal Risks in Crypto: The legal landscape is shifting rapidly. The more you understand about regulations and tax frameworks, the better prepared you’ll be to navigate the crypto world safely.

Why This Matters to You

The way governments are approaching crypto could completely change how you interact with it. The SEC’s record fines highlight how important it is to follow the rules, especially as more countries adopt regulatory frameworks like the OECD’s CARF. Getting ahead of these changes will help you stay out of trouble and ensure you’re not caught off guard when new laws come into play.

In short, understanding how these fines, regulations, and tax policies work is crucial for anyone involved in cryptocurrency, whether you’re just starting or have been in the game for a while. Stay informed, stay compliant, and you’ll be better equipped to take advantage of the crypto industry’s future.