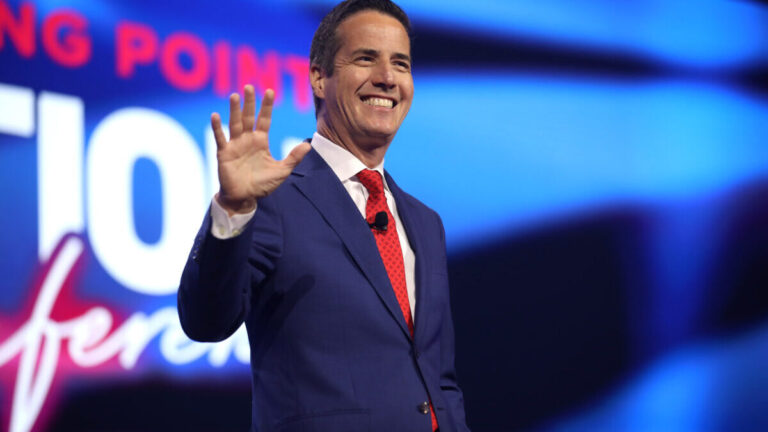

In a surprising turn of events, crypto-friendly Republican candidate Bernie Moreno just clinched a win in the high-stakes U.S. Senate race against long-time Democratic Senator Sherrod Brown. With the win, Moreno, who has consistently supported cryptocurrencies, is now in a prime position to influence crypto legislation in the U.S. Senate. Here’s why this victory matters for the future of digital assets and why you need to understand it.

The Battle for Crypto’s Future

Senator Brown, who had held his seat since 2007, has long been viewed as a critic of the crypto industry. As the chair of the Senate Banking Committee, he held significant power over crypto legislation, including bills that could restrict or regulate the industry more strictly. Brown has repeatedly called for tougher actions against cryptocurrencies, especially in terms of preventing their use for illegal activities like funding terrorism or evading sanctions.

But now, with Brown out of the Senate picture, a key opportunity arises for crypto supporters. Bernie Moreno, a businessman who co-founded a blockchain-based car title company, has made it clear that he intends to defend the crypto space. His mission? To “lead the fight to defend crypto in the U.S. Senate,” as he said in an interview earlier this year.

Why Does This Matter?

Moreno’s victory signals a potential shift in how crypto could be regulated in the United States. By winning the seat, Moreno will now have the power to push for policies that favor the expansion of the cryptocurrency market. And with Republicans securing a Senate majority, the stage is set for more crypto-friendly regulations, especially with figures like Sen. Tim Scott, who is also pro-crypto, poised to become chair of the Senate Banking Committee.

This means that the U.S. government may start to focus on creating clearer rules to support the digital asset industry rather than restrict it. For example, Scott has proposed creating a subcommittee specifically for digital assets. These changes could provide much-needed clarity and security for businesses and individuals involved in the cryptocurrency space.

The Stakes Are High

The outcome of this election affects not just crypto investors but the entire blockchain and digital asset ecosystem. If crypto-friendly lawmakers like Moreno and Scott gain more influence, we could see a more stable and predictable regulatory environment. This would encourage innovation and investment in the industry, which in turn could drive up the adoption and value of digital currencies and blockchain technologies.

On the flip side, if figures like Sen. Elizabeth Warren, a known critic of crypto, had taken control, it could have meant stricter rules and regulations that could stifle the growth of digital assets in the U.S. Warren has been pushing for laws that would force crypto businesses to follow strict anti-money laundering measures, which could slow down the innovation in the industry.

The Bigger Picture

This win for Bernie Moreno and the Republican push for crypto-friendly policies represents a larger fight for the future of innovation in America. Will the U.S. embrace new technologies and lead the way in digital currencies, or will it fall behind other countries that have already started to implement more crypto-friendly regulations?

For you, understanding the political landscape around crypto is critical. The outcome of elections like these shows how government decisions directly impact industries and technologies that could shape your financial future. If you’re interested in crypto or blockchain, knowing who controls the levers of power and how they plan to regulate these technologies is essential. It’s not just about understanding today’s market—it’s about preparing for the future.

Key Terms to Remember

- Senate Banking Committee: The Senate committee that holds power over financial regulations, including those for crypto.

- Blockchain: The technology behind cryptocurrencies that allows secure, transparent transactions.

- Crypto-friendly regulations: Laws that support the growth and adoption of digital assets, like Bitcoin and Ethereum.

- Anti-money laundering (AML) rules: Laws designed to prevent illegal financial activities, such as money laundering and terrorism financing.

- Tim Scott: A Republican senator who supports crypto and could become the chair of the Senate Banking Committee.

This election isn’t just about one race—it’s about shaping the rules for an entire emerging industry. The battle for crypto is on, and with the right policies, the potential for growth is limitless.