Hook: Are we about to witness another tech revolution, or is the Bitcoin mining industry on the brink of a bust?

In a recent discussion with Bernstein, Fred Thiel, CEO of the Bitcoin mining company MARA (formerly known as Marathon Digital), compared today’s landscape of artificial intelligence (AI) to the explosive growth of the internet in the early 2000s. He raised a red flag, warning that many companies, especially smaller ones, may be building too much infrastructure without a strong enough demand to support it. This could lead to financial struggles if they can’t make enough money from clients.

Why This Matters

- Historical Context: The early 2000s internet boom was marked by rapid growth but also a significant amount of overbuilding. Companies invested heavily, hoping for success, but many failed when the demand didn’t match their expectations. Understanding this comparison helps you grasp the risks associated with new tech trends today.

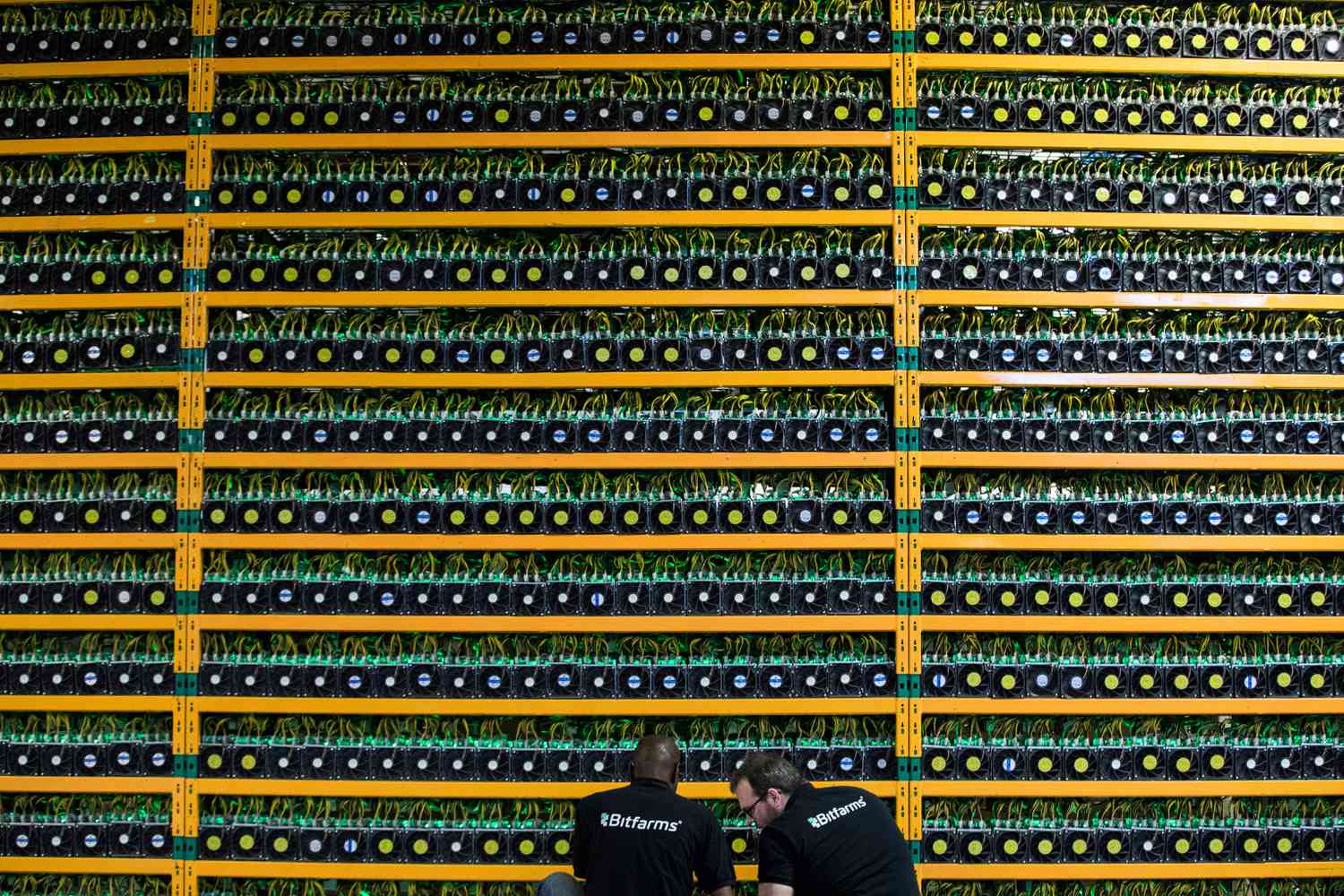

- AI and Bitcoin Mining: While the article emphasizes the risks, Thiel believes that Bitcoin miners like MARA can benefit from incorporating AI into their operations over the long term. By partnering with AI data centers, they could take advantage of low-cost energy, positioning themselves as “energy partners.”

- Diverging Strategies: In 2024, the strategies of Bitcoin miners are splitting. Some companies are focusing solely on Bitcoin mining, while others are diversifying into AI-related services. The firms that are adding AI components to their offerings are currently outperforming those that stick strictly to Bitcoin.

- Cost Management: MARA is focusing on owning its mining capacity and generating energy on-site using stranded or flare gas, which is cheaper than traditional energy sources. This gives them a competitive edge, allowing them to mine Bitcoin at a significantly lower cost than their competitors.

- Investment in Technology: MARA is not just focused on mining; they’re also investing in the development of advanced mining technology through their partnership with Auradine. This collaboration allows them to create specialized mining equipment, increasing efficiency and reducing reliance on other manufacturers.

- Future Goals: Thiel has ambitious plans to ensure that half of MARA’s revenue comes from non-Bitcoin mining and other operations within the next four years. This diversification is essential to create a robust technology company that can adapt to changing markets.

Key Takeaways

- Watch for Trends: Understanding the potential risks of overbuilding infrastructure can help you make better investment choices. Just because a sector is booming doesn’t mean all players will succeed.

- Energy Efficiency is Key: The ability to mine Bitcoin at lower costs through innovative energy solutions can be a game-changer in this industry.

- Adaptability Matters: Companies that are willing to diversify and integrate new technologies, like AI, are more likely to thrive in the long run.

- Knowledge is Power: As you delve into cryptocurrency and Bitcoin mining, keep an eye on how companies evolve and adapt to the market. This knowledge is crucial in making informed investment decisions.

Why Build Knowledge in This Field?

By understanding these dynamics, you’ll be better equipped to navigate the complexities of the cryptocurrency market. Knowledge in this area is not just about trading; it’s about comprehending the underlying technologies, trends, and risks that can influence your investments. The Bitcoin and AI landscape is evolving rapidly, and being informed allows you to seize opportunities while avoiding potential pitfalls.

Investing time in learning about this field can lead to greater financial success and a deeper understanding of how technology shapes our future.