Hook: As the world of cryptocurrency futures trading shifts, decentralized exchanges are losing ground to centralized platforms. What does this mean for the future of trading?

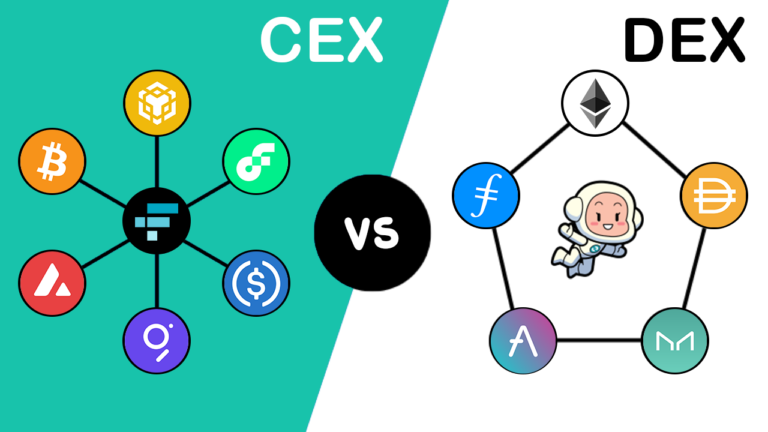

Imagine you’re a part of the growing crypto world, where traders are making big moves, buying and selling contracts to bet on the future prices of coins like Bitcoin. In this game, there are two main types of platforms where people trade: Decentralized Exchanges (DEXs) and Centralized Exchanges (CEXs). DEXs promise total freedom, without the need for middlemen, while CEXs are like the big established players in the market, offering fast, smooth services but with more control over your assets.

Now, in this article, we’re seeing that DEXs are struggling to keep up with the futures market, which is where traders speculate on the future value of cryptocurrencies. Futures trading is massive because it allows people to bet on price movements without owning the actual crypto. Traders love this fast-paced environment, and it’s where serious money is made.

The Key Numbers: Why Should You Care?

In February 2024, DEXs had 5.18% of the market share in futures trading, which was a high point. However, by September, that dropped to 3.26%. While this might not sound like a huge drop, it shows a steady shift of traders back to centralized platforms (CEXs) like Binance. This means that, even though DEXs are still in the game, they’re not winning the race when it comes to futures trading.

Why are DEXs Losing Ground?

- Liquidity: This is the first big word to remember. It refers to how easily you can buy or sell without affecting the price too much. CEXs like Binance have massive pools of assets, meaning you can trade large amounts quickly without the price moving much. DEXs, on the other hand, have less liquidity, which can lead to worse prices and more “slippage” (a term for when the price moves against you during a trade).

- User Experience: CEXs have smooth, easy-to-use interfaces. DEXs, on the other hand, can feel clunky and complicated, especially if you’re new. They often require interacting with smart contracts and paying gas fees, which are extra charges for using the blockchain network. For many, these extra steps are confusing or expensive, making CEXs the more attractive option.

The Promise of Decentralization: What’s the Appeal?

Despite these challenges, DEXs are built on the idea of true decentralization. This means they don’t have a central authority, giving users more control over their assets and trading. In a world where people value privacy and ownership, DEXs represent freedom from centralized control. But, as this article shows, even with that promise, traders still prefer CEXs for futures trading because of liquidity and ease of use.

What’s Next for DEXs?

The article hints at some exciting developments that might help DEXs catch up:

- Better liquidity: Finding ways to bring more assets into DEXs so traders can buy and sell with less slippage.

- User-friendly platforms: Making DEXs easier to use, so they can compete with the polished interfaces of CEXs.

- Cross-chain futures: This is a fancy term for allowing trades to happen across different blockchains, making DEXs more flexible and potentially more appealing to traders.

Why This Matters to You

As someone interested in cryptocurrency, this article highlights an important trend in the market. Understanding the differences between DEXs and CEXs and how they impact futures trading will help you make smarter decisions. Right now, most serious traders are sticking with CEXs like Binance because of their liquidity and ease of use, but that doesn’t mean DEXs won’t evolve and become more competitive in the future.

Building your knowledge on this now could give you an edge as the crypto market continues to grow and change. Keep an eye on developments in decentralized finance (DeFi) and futures trading, as these areas are full of innovation and potential profit. If DEXs can overcome their current hurdles, they could become a major force in the future of trading.

By paying attention to these shifts, you’ll not only stay informed, but you’ll be prepared to act when the market changes, putting yourself ahead of the game in crypto.