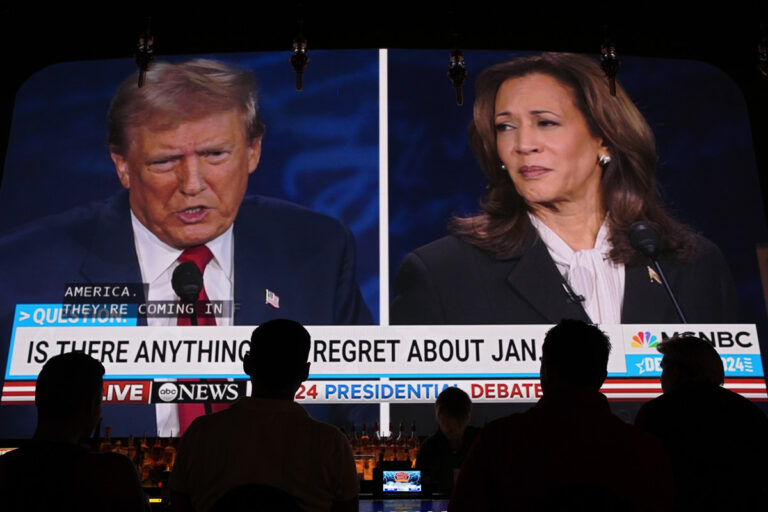

Imagine you’re watching the news, and suddenly, you hear that a whopping $407 million flooded into cryptocurrency funds in just one week. That’s huge! This massive inflow didn’t come from random market moves—it was sparked by a political shift. With the U.S. presidential elections around the corner, many investors are betting that if Republicans win, especially Donald Trump, it could be good for cryptocurrencies.

The Big Picture: What’s Happening?

Last week, crypto funds (like those run by big names such as BlackRock and Fidelity) saw an incredible turnaround. After experiencing some losses the week before, these funds bounced back with $407 million in net inflows. The term “net inflows” refers to the amount of money coming into these funds minus the amount leaving them. What’s really interesting is why this happened: many believe it’s tied to the U.S. elections and the increasing chances of a Republican win.

Why Does Politics Matter in Crypto?

You might be wondering, “What do politics have to do with cryptocurrency?” Well, the Republican party is often seen as more supportive of digital assets, and investors believe that if they come into power, regulations might be more favorable for crypto. When people think there’s a better future for Bitcoin and other digital currencies, they invest more, pushing prices up.

Key terms to remember:

- Net Inflows: The difference between the money entering and leaving the funds.

- Bitcoin ETFs: These are investment products that track the price of Bitcoin but trade like a stock, making it easier for people to invest in Bitcoin without directly buying it.

What About Bitcoin?

Bitcoin was the star of the show last week. It saw the most investment, with $419 million pouring in. This made it the “primary beneficiary” of this political shift, according to James Butterfill, the Head of Research at CoinShares. People were clearly betting that Bitcoin would do well if Republicans win the U.S. elections.

Interestingly, U.S.-based funds were the big players in this trend, while funds in places like Europe and Asia didn’t see the same positive movement. This shows how closely tied cryptocurrency is to the U.S. political climate right now.

What About Other Cryptos?

While Bitcoin saw a lot of love, Ethereum wasn’t as lucky. Ethereum-based products lost around $9.8 million globally, showing that not all digital assets are experiencing the same surge. This could be due to various factors, including how people perceive each asset’s future.

However, there was also positive news for multi-asset investment products (which include multiple cryptocurrencies) and blockchain equity ETFs, which saw good inflows. This indicates that investors are not just putting all their money into Bitcoin but are also looking at other blockchain-related opportunities.

Why Is This Important for You?

Understanding these trends is crucial because cryptocurrency is no longer just a niche for tech enthusiasts—it’s becoming a significant part of global finance. Political events, economic data, and even debates can influence the market, and learning how these factors interact can help you make informed decisions as an investor. By staying informed about how politics and global events affect crypto, you can better predict market movements and seize investment opportunities.

In summary:

- Political shifts (like the upcoming U.S. elections) are driving crypto investments.

- Bitcoin is seeing the most benefit, with huge inflows of $419 million.

- Not all cryptos are doing well—Ethereum is still struggling.

- Keeping an eye on how politics impacts finance can help you build your knowledge and make better decisions in the crypto space.

By understanding how these forces play out, you’ll not only be better prepared for the future of digital finance but also improve your ability to spot opportunities in this rapidly growing field.