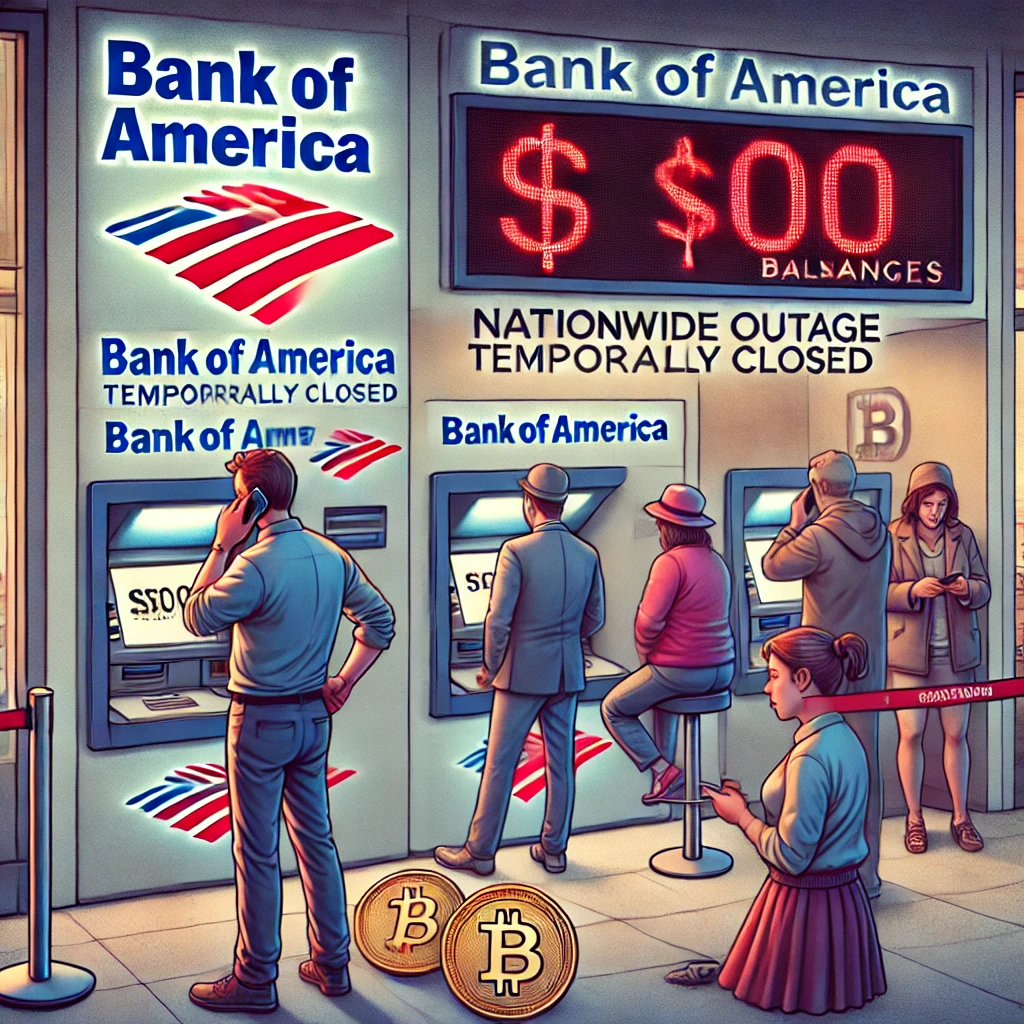

Imagine waking up, checking your Bank of America account, and seeing a big, fat $0 balance staring at you. That’s exactly what happened to thousands of customers on October 2, sparking panic and frustration. For hours, people couldn’t access their money online or on mobile apps, leaving them confused and angry.

People flooded social media, saying things like “My money is gone, but my debt is still here!”—a situation that made many lose trust in the bank. Even walking into the physical branches didn’t help, as some ATMs weren’t showing balances, though withdrawals were still possible.

Why is This a Big Deal?

Bank outages like this expose a huge flaw in traditional banking: your access to your own money isn’t guaranteed. As you might imagine, people felt helpless, trapped in a system that could fail them at any time. While Bank of America later said the issue was fixed, many customers were still struggling to get back online. In times like these, alternatives like Bitcoin start to seem very appealing.

Here’s Why Bitcoiners Are Smiling

Bitcoin has been around for over a decade and has experienced practically zero downtime since 2013. That’s impressive, especially when you compare it to traditional banks, which can suddenly shut down for hours, leaving you with no control over your funds.

Key takeaway? Events like this make a strong case for self-custody of your assets. Instead of relying on banks, Bitcoin allows you to manage your own money without a middleman. That’s freedom that the traditional banking system just doesn’t offer.

What Should You Learn From This?

- Banks Can Fail: Just because your money is in a big, trusted institution doesn’t mean you have access to it 24/7. Outages happen, and when they do, you’re left in the dark.

- Bitcoin’s Uptime is Impressive: No downtime since 2013. In a world where outages can happen at any moment, Bitcoin’s reliability makes it an interesting alternative.

- Self-Custody Matters: Keeping control of your assets in a decentralized system like Bitcoin means you’re not relying on banks to keep your money safe and accessible.

So next time you think about where your money is, remember that the banking system is not as invincible as it seems. This might be your sign to dig deeper into decentralized finance and the future of money.