In the world of cryptocurrency, two names stand out: Bitcoin and Ethereum. While both are significant in the crypto space, they serve different purposes and have distinct features that make them unique. Let’s break down what sets them apart and why understanding these differences is crucial for anyone looking to dive into the world of digital currencies.

The Basics: What Are Bitcoin and Ethereum?

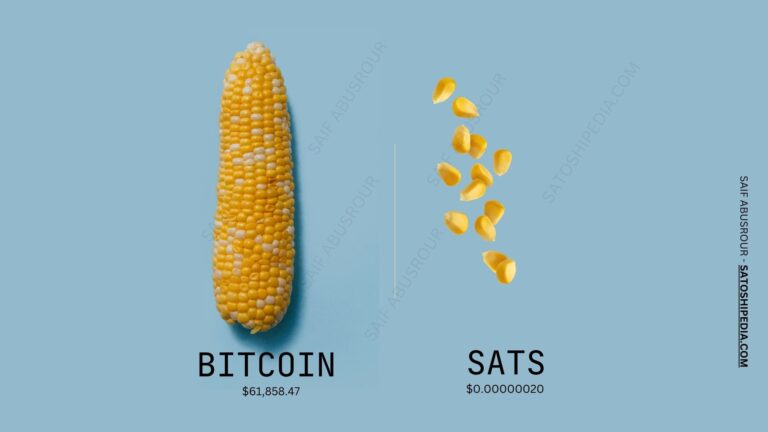

- Bitcoin (BTC): Often called digital gold, Bitcoin was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. It was the first cryptocurrency and primarily serves as a digital currency. People use Bitcoin to send money over the internet without needing a bank. Its main selling point is decentralization, meaning no single entity controls it.

- Ethereum (ETH): Launched in 2015, Ethereum goes beyond just being a digital currency. It’s a platform that allows developers to build decentralized applications (dApps) using smart contracts. Smart contracts are self-executing contracts with the terms directly written into code, allowing for trustless transactions without the need for intermediaries.

Key Differences Between Bitcoin and Ethereum

- Purpose and Use Case:

- Bitcoin: Primarily a digital currency meant for transactions and as a store of value.

- Ethereum: A platform for building decentralized applications and executing smart contracts.

- Technology:

- Bitcoin: Uses a simple blockchain that primarily records transactions.

- Ethereum: Features a more complex blockchain that can execute code, enabling it to support dApps and smart contracts.

- Supply:

- Bitcoin: Has a capped supply of 21 million coins, which adds to its scarcity and value.

- Ethereum: Currently has no fixed supply limit, allowing for more flexibility, but this can impact its value in the long term.

- Transaction Speed:

- Bitcoin: Transactions can take longer due to its block time of about 10 minutes.

- Ethereum: Generally faster, with a block time of around 15 seconds, which makes it more suitable for quick transactions and dApps.

- Community and Development:

- Bitcoin: Maintains a conservative approach to changes, focusing on security and stability.

- Ethereum: More experimental, with a vibrant community constantly innovating and developing new applications.

Why Understanding These Differences Matters

- Informed Investment: Knowing what each cryptocurrency does helps you make smarter investment decisions. If you believe in the potential of smart contracts and dApps, Ethereum might be a better choice. If you see value in a stable, established currency, Bitcoin could be more appealing.

- Navigating the Crypto Market: The cryptocurrency landscape is vast and evolving. Understanding the key players and their functionalities allows you to navigate this space confidently, making it easier to spot opportunities.

- Future Trends: As the world becomes more digital, cryptocurrencies are likely to play a larger role in our daily lives. Being informed about Bitcoin and Ethereum helps you understand the future of money, technology, and decentralized systems.

- Building Knowledge: Knowledge is power. The more you learn about these technologies, the more equipped you’ll be to engage in discussions, spot trends, and even develop your projects in the crypto space.

Conclusion: Embrace the Knowledge

In conclusion, understanding the differences between Bitcoin and Ethereum is not just about grasping technical details—it’s about empowering yourself in a rapidly changing financial landscape. As you grow your knowledge in this field, you’ll find yourself better prepared to make informed decisions, seize opportunities, and potentially shape your financial future. So, dive deep, ask questions, and don’t shy away from the complexities; this is where the real growth happens!