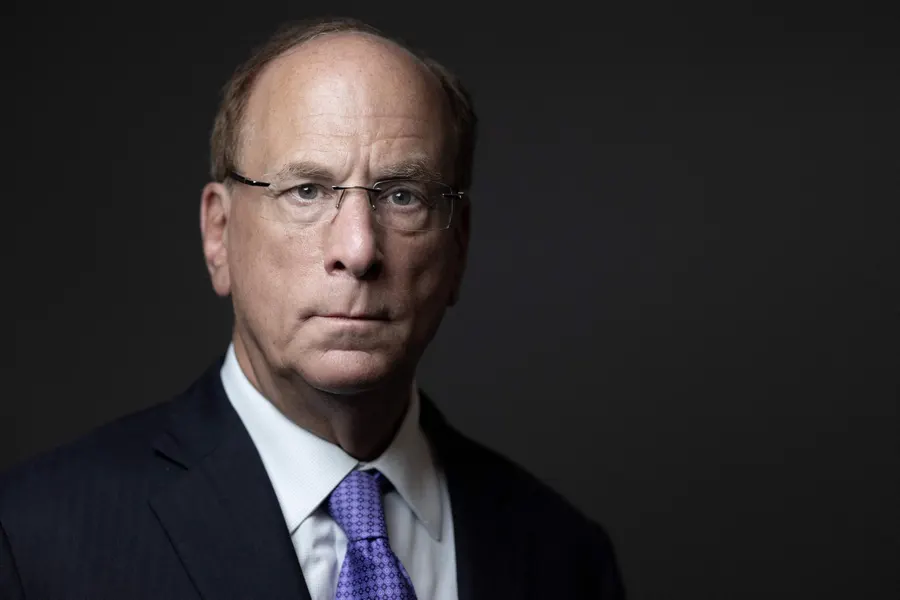

Bitcoin (BTC) has recently experienced a notable rebound, rising back to approximately $60,000 after a significant drop toward $50,000 due to “extreme fear” gripping the market. This recent surge follows a rough start to September, where Bitcoin’s price fell substantially. Analysts from BlackRock, one of the world’s largest asset managers and a prominent issuer of Bitcoin spot exchange-traded funds (ETFs), have issued a stark warning about potential future volatility. They anticipate that the Federal Reserve (Fed) will not cut interest rates as aggressively as the market expects, which could impact Bitcoin and broader financial markets.

Despite the recent rebound, Bitcoin remains vulnerable to further volatility. Several factors are contributing to this uncertain outlook. These include resurfacing fears of a recession due to softer economic data, jitters related to the upcoming U.S. presidential election, and ongoing profit-taking by investors. BlackRock’s strategists, led by Jean Boivin, have highlighted that market conditions are likely to remain turbulent with multiple factors driving volatility. This includes concerns over the Fed’s monetary policy and its potential impact on both inflation and economic growth.

The Bitcoin price saw a significant decline last week, primarily driven by a weaker-than-expected U.S. job report. This report heightened fears that the Fed might have delayed too long in cutting interest rates, possibly pushing the economy toward a recession. Although inflation has been decreasing and is nearing the Fed’s target, there are concerns that higher inflation in the medium term could limit the extent to which the Fed can lower rates. This dynamic has contributed to falling yields on 10-year government bonds, reflecting investor expectations of more substantial rate cuts.

Looking ahead, the Federal Reserve is scheduled to meet on September 17 to discuss potential rate cuts. This meeting is critical as it could set the tone for future monetary policy and market conditions. A rate cut could potentially offer relief to both Bitcoin and broader financial markets by providing cheaper borrowing costs and additional liquidity. However, if the Fed’s actions fall short of market expectations, it could exacerbate existing market uncertainties and lead to further price fluctuations in Bitcoin and other assets.

BlackRock’s analysis underscores the precarious nature of the current market environment. The firm anticipates that factors such as recession risks, pre-election uncertainty, and profit-taking will continue to drive market volatility. Furthermore, with the presidential election approaching, the outcome could significantly impact Bitcoin’s future price movements. Analysts have noted that if the election results in favorable regulatory policies for cryptocurrencies, it could spur innovation and positively affect Bitcoin prices. Conversely, adverse policy changes could contribute to further declines.

Overall, the market remains in a delicate balance, with upcoming economic data and policy decisions playing a crucial role in shaping the future trajectory of Bitcoin and broader financial markets.