Bitcoin’s Expanding Role: From Store of Value to Global Economic Player

Bitcoin’s role in the financial world is evolving beyond its traditional use as a store of value. Recent discussions highlight Bitcoin’s potential to serve as a currency, a technological innovation, and a significant asset class in the global economy. The conversation featured insights from Mason Jappa, Co-Founder and CEO of Blockware, and Craig Shapiro, Founder of The Alethea Narrative, who shared their perspectives on Bitcoin’s future.

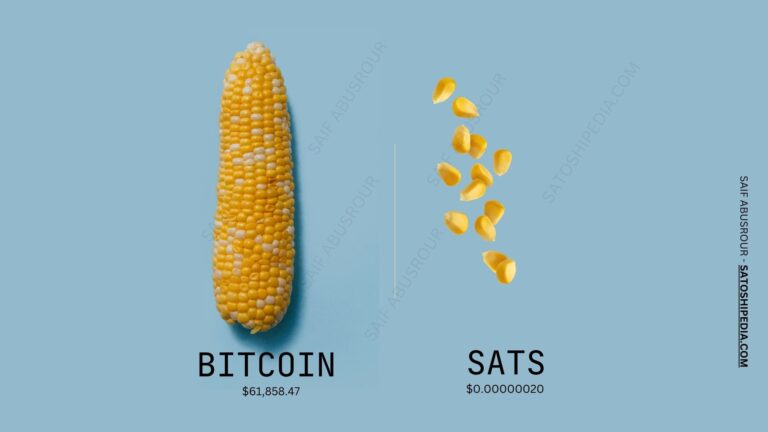

Mason Jappa emphasized Bitcoin’s decentralized nature and its capacity for facilitating low-cost global transactions. He predicted that Bitcoin could become the most valuable asset class globally within this decade, driven by its finite supply of 21 million coins. Jappa views Bitcoin as a “perfect mathematical system” that provides unique advantages in terms of transaction efficiency and security.

Craig Shapiro focused on Bitcoin’s potential as a store of value. He pointed out that Bitcoin’s lack of carrying costs sets it apart from traditional assets such as gold and real estate. Shapiro highlighted that Bitcoin can be stored indefinitely on a personal hard wallet without incurring ongoing expenses, making it an attractive alternative to conventional investments.

Both Jappa and Shapiro agreed that Bitcoin is transforming perceptions and values in the financial world. Jappa concluded that Bitcoin is “here to stay” and is establishing itself as a new benchmark in the global economic landscape. This transformation reflects Bitcoin’s growing influence and its role in shaping future financial systems.