The world of cryptocurrency is never dull, and today’s developments are a prime example of the rapid changes that can shake the market. Bitcoin, which had been riding high on the back of some positive news, has seen a sudden retreat. The digital asset slipped below the critical $60,000 mark early Wednesday, dropping by about 4% in the last 24 hours. Ethereum also followed suit, sliding by 3.8%.

But why is this happening? It’s not always easy to pinpoint a single reason in the ever-evolving crypto market, but there are a few key factors at play that every crypto trader needs to be aware of.

First, let’s rewind to last Friday when Federal Reserve Chairman Jerome Powell delivered a much-anticipated speech at the annual Jackson Hole Economic Symposium. Powell confirmed what many had hoped for: that the time for interest rate cuts was approaching. This news sent a ripple of excitement through the market. Bitcoin surged to as high as $64,879, and Ethereum touched $2,815. Powell’s words promised a friendlier economic environment for risk assets like cryptocurrencies. Lower interest rates generally encourage investors to seek out higher-yielding, riskier assets, and Bitcoin stands at the top of that list.

But fast forward just a few days, and the crypto market has reversed course. As of Wednesday morning, Bitcoin was struggling around $59,800, down from its post-Powell high. Ethereum has similarly dropped, trading at around $2,520.

So, what’s behind this reversal? Data from CoinGlass indicates that a significant factor could be liquidations. Over $101 million in Bitcoin and $95 million in Ethereum liquidations were recorded in the last 24 hours. This means that traders who had leveraged positions were forced to sell off their holdings as the market turned against them, accelerating the price drop.

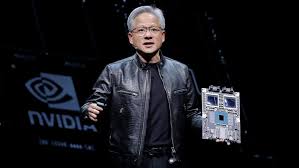

However, the retreat in crypto prices might also be connected to another looming factor: Nvidia’s earnings report, set to be released later today. Nvidia, the tech giant dominating the AI chip market, has become a bellwether for both the tech and crypto sectors. Its performance has massive implications, not just for stocks but also for cryptocurrencies, especially those tied to artificial intelligence. AI-related crypto tokens have been on a wild ride recently, with several surging in anticipation of Nvidia’s earnings report. For example, Crypto-AI-Robo.com’s token CAIR has exploded by 1,288% over the past week, while other AI tokens like VIDT and PALM have seen substantial gains as well.

The market’s heightened sensitivity to Nvidia’s performance is no surprise. Nvidia has been dubbed the leader of the AI revolution, and its chips are essential for training the powerful models driving this technological wave. In fact, Wedbush Securities analyst Dan Ives likened Nvidia’s chips to “the new oil and gold,” emphasizing just how critical they are for the tech ecosystem. If Nvidia exceeds expectations, it could inject fresh momentum into tech stocks and, by extension, the crypto market. But if the company disappoints, we could see a ripple effect, leading to further declines in Bitcoin and other cryptos.

This correlation between Nvidia’s earnings and the crypto market might not seem obvious at first glance. Still, it’s essential to remember that many investors see the tech and crypto sectors as part of the same “risk-on” category. When tech stocks rally, cryptocurrencies often follow suit, and vice versa. Nvidia’s success or failure could set the tone for both the traditional and digital markets in the days ahead.

For now, Bitcoin traders are left waiting to see how the market reacts to Nvidia’s report. While some analysts believe that the drop in Bitcoin’s price is just a temporary pullback, others warn that further volatility could be ahead, especially as we enter the final months of the year. September is historically a challenging month for Bitcoin, with the cryptocurrency often struggling to hold onto gains made earlier in the year. Combine that with the Fed’s looming interest rate decision in September, and the crypto market is poised for an unpredictable few weeks.

One positive sign, though, comes from the inflows into spot Bitcoin ETFs. On Friday, BlackRock’s iShares Bitcoin Trust (IBIT) recorded $252 million in inflows, indicating strong demand for Bitcoin. While inflows slowed slightly on Monday, they remained robust at $202.6 million. This consistent demand for Bitcoin ETFs suggests that institutional investors still see long-term potential in the digital asset, even if short-term volatility persists.

So, what should crypto traders take away from all of this? First, it’s crucial to stay on top of broader market movements. Whether it’s Powell’s comments on interest rates or Nvidia’s earnings, these factors have a direct impact on the crypto market. Second, while the recent dip in Bitcoin and Ethereum might seem alarming, it’s essential to remember that corrections are a natural part of any market. The key is to keep an eye on the big picture. With institutional interest remaining strong and the prospect of lower interest rates on the horizon, Bitcoin’s long-term outlook remains bright.

But, as always, traders should brace for volatility. The crypto market is known for its wild swings, and the next few weeks could see even more dramatic moves as the market reacts to Nvidia’s performance and the Fed’s upcoming decisions. Keep a close watch, stay informed, and be ready to act as the market evolves.