Bitcoin’s role in the global financial system is becoming increasingly significant as its adoption grows and its use cases expand. As the world’s first cryptocurrency, Bitcoin is influencing financial markets and reshaping traditional concepts of value and currency.

Bitcoin as a Store of Value

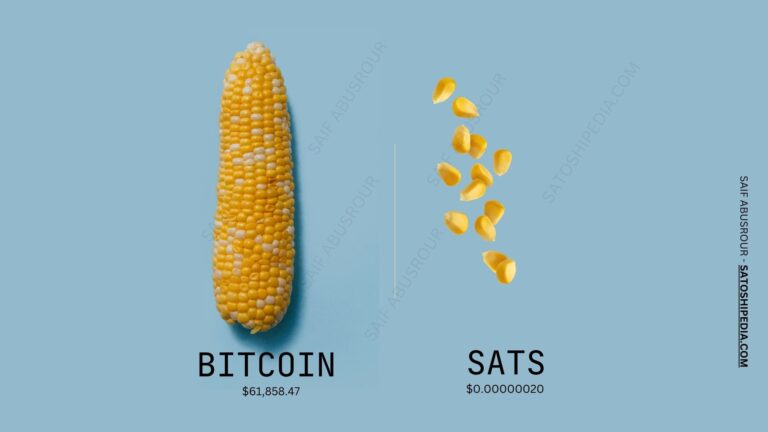

One of the key roles of Bitcoin is its function as a store of value. Unlike traditional fiat currencies, Bitcoin operates on a decentralized network and has a fixed supply limit of 21 million coins. This scarcity, combined with its security and transparency, makes Bitcoin an attractive asset for investors seeking to hedge against inflation and economic uncertainty.

Bitcoin’s growing acceptance as a store of value is reflected in its increasing adoption by institutional investors and corporations. Companies like El Salvador have adopted Bitcoin as legal tender, while investment firms are adding Bitcoin to their portfolios as a hedge against traditional financial market risks.

Bitcoin’s Impact on Traditional Banking

Bitcoin is also challenging traditional banking systems and financial intermediaries. With its decentralized nature, Bitcoin allows for peer-to-peer transactions without the need for intermediaries like banks. This has implications for cross-border payments, remittances, and financial inclusion, particularly in regions with limited access to traditional banking services.

Furthermore, Bitcoin’s impact on traditional banking extends to the development of financial products and services. Financial institutions are exploring ways to integrate Bitcoin and other cryptocurrencies into their offerings, including providing custody solutions and trading platforms for digital assets.

Regulatory and Market Considerations

The growing influence of Bitcoin on the global financial system brings regulatory and market considerations. Governments and regulatory bodies are grappling with how to address Bitcoin’s role and ensure consumer protection while fostering innovation. The regulatory landscape for Bitcoin is evolving, with some jurisdictions adopting more favorable approaches while others impose stricter regulations.

Additionally, Bitcoin’s volatility and market dynamics pose challenges for its integration into traditional financial systems. The price fluctuations of Bitcoin can impact its effectiveness as a store of value and its role in financial transactions.

Future Outlook

As Bitcoin continues to gain traction and influence, its role in the global financial system is likely to expand further. The continued development of Bitcoin-related technologies and financial products will shape its integration into traditional finance and impact its role in the global economy.

For crypto traders and investors, staying informed about Bitcoin’s evolving role and market trends is essential for making strategic investment decisions. Understanding the broader implications of Bitcoin’s influence on the financial system will help traders navigate the changing landscape and identify opportunities for growth.

Bitcoin’s role in the global financial system is becoming increasingly prominent as its adoption grows and its use cases expand. As a store of value and a challenger to traditional banking systems, Bitcoin is reshaping financial markets and influencing economic concepts. For traders and investors, understanding Bitcoin’s evolving role and its impact on the financial system is crucial for navigating the dynamic landscape of cryptocurrency and making informed investment decisions.