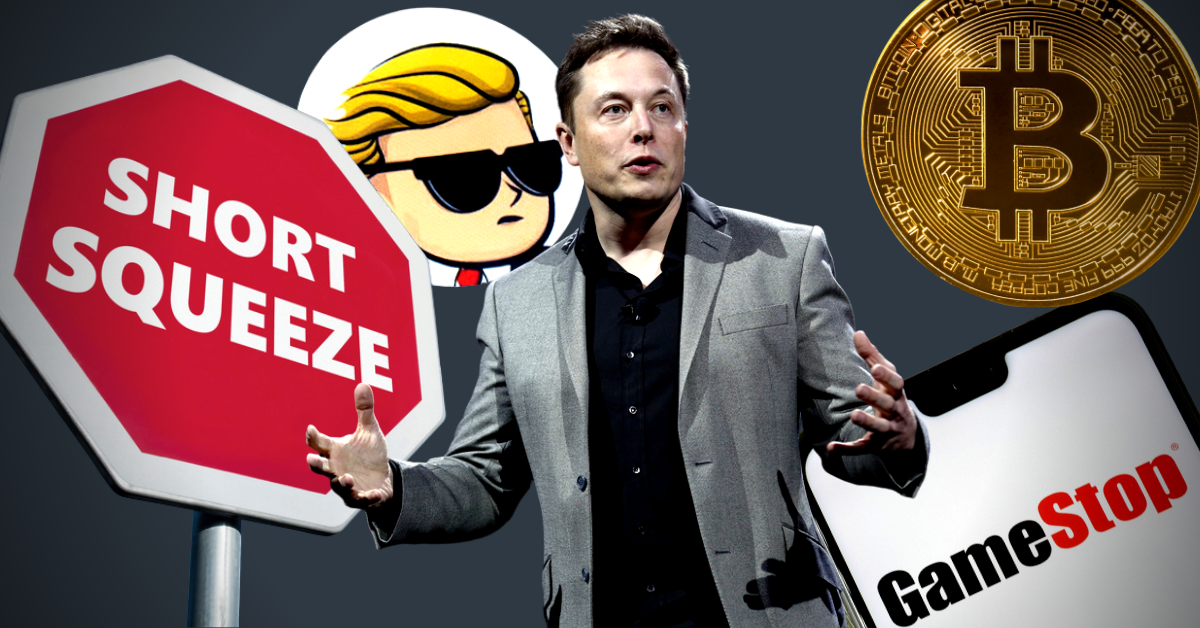

Andrew Left, a well-known figure in the financial world, particularly for his role in the GameStop trading saga, is now in serious legal trouble. The U.S. Securities and Exchange Commission (SEC) has accused him of manipulating stock prices through misleading posts on social media platform X (formerly Twitter). This case could have significant implications for how market commentary is perceived, especially among crypto traders who frequently monitor such platforms for trading signals.

The Heart of the Case

The SEC’s lawsuit alleges that Left, along with his firm Citron Research, engaged in fraudulent activities by posting deceptive comments about various stocks, including GameStop, Tesla, Nvidia, and others. These posts, which have since been deleted, were allegedly used to manipulate the market and profit from the ensuing price movements.

For instance, Left’s comments on GameStop were part of a broader strategy to drive the stock price down while he held short positions. However, retail investors, particularly those from the Reddit community r/WallStreetBets, countered by buying up GameStop shares, causing Left substantial losses. The Justice Department now claims that Left’s actions were part of a deliberate plan to influence market prices for his gain.

A Pattern of Manipulation

The indictment details several instances where Left allegedly manipulated stock prices:

- Roku Inc.: Left shorted Roku, called it “uninvestible,” and later deleted his post. Prosecutors allege this move was to manipulate the stock price, netting Left $700,000.

- Beyond Meat Inc.: After shorting Beyond Meat, Left posted negative comments, causing a price drop. He closed his position quickly, making substantial profits.

- American Airlines Group Inc.: Left shorted the stock, posted a negative assessment, and closed his position within 43 minutes, earning $429,000.

- Cronos Group Inc.: Left shorted Cronos, posted negative remarks, and began closing his position shortly after, making significant gains.

- Tesla Inc.: Promoted his long position in Tesla, sold more than half of it minutes later, making $1 million, and continued selling over the next trading day for a total profit of $6.6 million.

- Nvidia Corp.: Bought Nvidia stock based on a tip, promoted it, and sold all shares within two hours, earning $930,000.

- Facebook Inc.: Bought Facebook shares, posted a favorable analysis, and sold within hours, making $680,000.

Defense and Implications

Left’s defense attorney argues that his posts reflected his genuine views and that there is no evidence these posts alone could significantly move large-cap stocks. He also emphasized that all information shared was public, not insider knowledge.

For crypto traders, this case underscores the importance of critically evaluating market commentary on social media. It also highlights the potential for regulatory scrutiny in an era where social media plays a crucial role in trading decisions. Understanding the fine line between genuine analysis and manipulation is vital for making informed trading choices.