Definition of Satoshis (Sats)

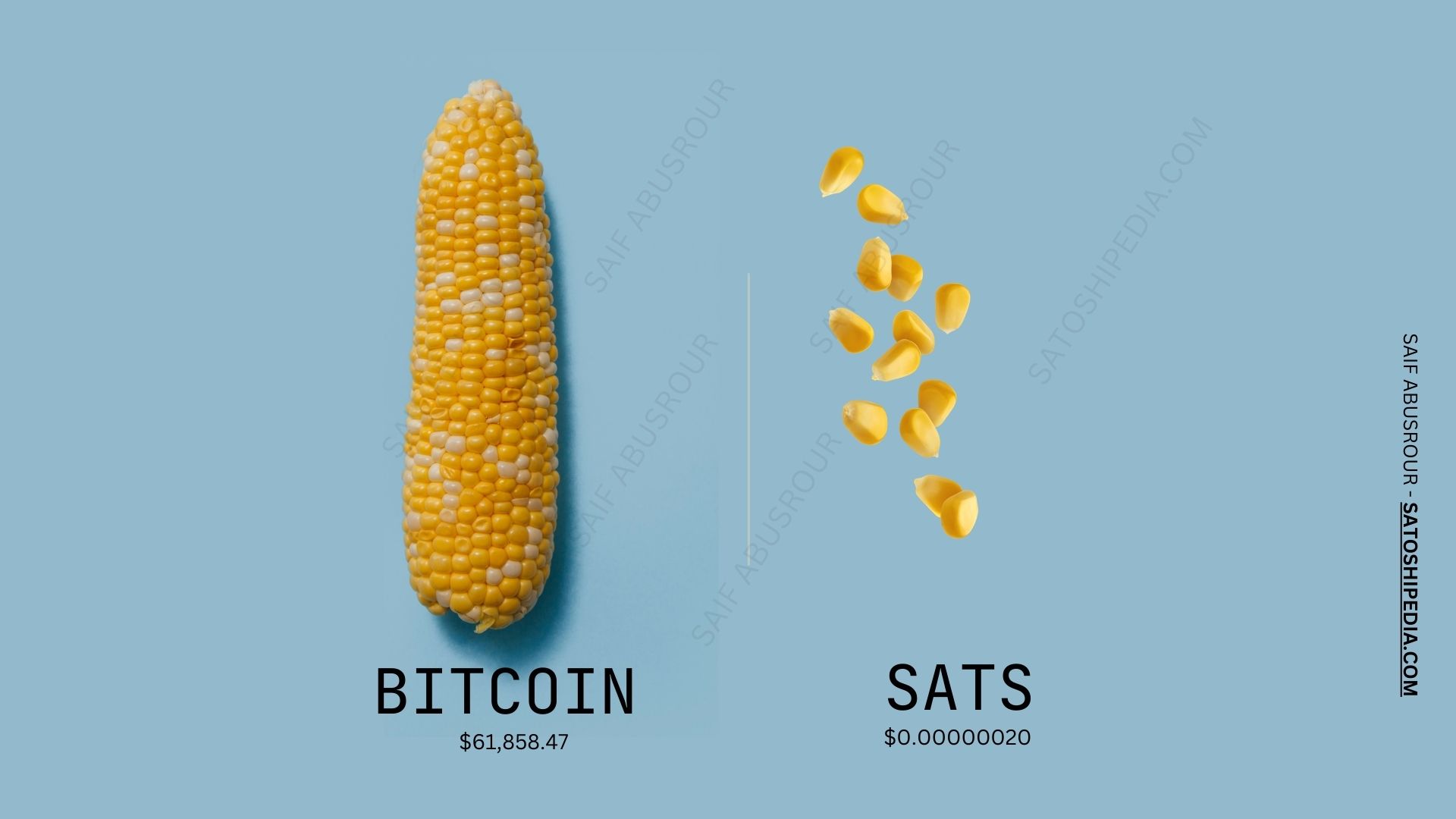

A satoshi, abbreviated as “sat,” is the smallest unit of Bitcoin (BTC). Named after Bitcoin’s pseudonymous creator, Satoshi Nakamoto, one Bitcoin can be divided into 100 million satoshis. This divisibility allows Bitcoin to be used for microtransactions and precise financial calculations, essential in both everyday transactions and complex financial operations.

Historical Context

Bitcoin was introduced in 2008 via a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto. The goal was to create a decentralized digital currency that could operate without central control, using blockchain technology to maintain a secure, transparent ledger of transactions. As Bitcoin’s value increased, the need for smaller units became evident, leading to the adoption of the satoshi as a standard unit.

Importance of Satoshis

- Microtransactions: Satoshis enable very small transactions, which are important in scenarios such as tipping, micro-purchases, and online content monetization. Handling transactions in whole Bitcoins would be impractical due to their high value.

- Scalability: By using satoshis, the Bitcoin network can handle numerous transactions efficiently, with each transaction precisely quantified and recorded.

- Adoption and Usability: For new users, the high value of a single Bitcoin can be daunting. Satoshis make Bitcoin more approachable by breaking it into manageable units.

Relationship Between Satoshis and Bitcoin

- Conversion: One Bitcoin (BTC) equals 100,000,000 satoshis (sats). This conversion is fundamental for users dealing with Bitcoin, as many wallets, exchanges, and merchants display values in both BTC and sats.

- Economic Implications: The divisibility into satoshis supports Bitcoin’s role as both a medium of exchange and a store of value. As Bitcoin’s value fluctuates, the ability to transact in smaller units becomes increasingly important for everyday use and in various economic contexts.

The Lightning Network and Satoshis

What is the Lightning Network?

The Lightning Network is a second-layer solution designed to address Bitcoin’s scalability issues, enabling faster and cheaper transactions. It operates on top of the Bitcoin blockchain, using a system of bidirectional payment channels that allow users to transact off-chain. Only the opening and closing of these channels are recorded on the blockchain, significantly reducing the load on the main network.

How the Lightning Network Works

- Opening a Channel: Two parties open a payment channel by committing a certain amount of Bitcoin to a multi-signature address. This transaction is recorded on the Bitcoin blockchain.

- Off-Chain Transactions: Within this channel, the parties can transact freely and rapidly in satoshis. These transactions are not broadcast to the blockchain, making them nearly instantaneous and extremely low-cost.

- Closing a Channel: When the channel is closed, the final balance is recorded on the Bitcoin blockchain, reflecting the net result of all the off-chain transactions.

Benefits of Using Satoshis on the Lightning Network

- Speed and Efficiency: By conducting transactions in satoshis off-chain, the Lightning Network drastically reduces confirmation times and transaction fees. This enhances Bitcoin’s practicality for everyday transactions.

- Micropayments: The Lightning Network excels in handling micropayments, which are often impractical on the main Bitcoin network due to high fees. Satoshis allow these small transactions to occur seamlessly and cost-effectively.

- Privacy: Since most transactions on the Lightning Network are not recorded on the blockchain, they offer greater privacy. Only the opening and closing transactions are public, keeping individual payments private.

- Scalability: The use of satoshis in the Lightning Network contributes to Bitcoin’s overall scalability by offloading a significant number of transactions from the main blockchain. This helps prevent congestion and maintains lower fees for on-chain transactions.

Practical Applications and Future Potential

Everyday Transactions

The ability to use satoshis on the Lightning Network opens numerous possibilities for everyday transactions. Online content creators, for example, can receive micro-tips in sats, enabling a new form of monetization. Similarly, businesses can handle high volumes of small transactions efficiently, enhancing customer experience and potentially expanding their market reach.

Financial Instruments

Satoshis and the Lightning Network pave the way for innovative financial instruments and services. For instance, decentralized finance (DeFi) platforms can leverage the scalability and low-cost transactions to offer new products like micro-loans or instant remittances. These services operate more smoothly with the precision and efficiency provided by sats.

Global Economic Impact

In regions with unstable currencies or limited access to traditional banking, Bitcoin and the Lightning Network offer a stable and accessible alternative. By transacting in satoshis, users can protect their wealth and participate in the global economy without the barriers imposed by their local financial systems.

Technical Overview

Bitcoin’s Blockchain and Satoshis

Bitcoin’s blockchain is a distributed ledger that records all transactions across a network of computers. Each block contains a list of transactions, a timestamp, and a reference to the previous block, forming a chain. The smallest unit recorded in this ledger is a satoshi. When a transaction is made, it can involve fractions of a Bitcoin, denominated in satoshis, which are then aggregated into blocks and added to the blockchain.

Transaction Mechanics

Transactions in Bitcoin involve inputs (the source of the Bitcoin) and outputs (the destination). Each input references a previous transaction’s output, and each output specifies the amount in satoshis. When making a transaction, users specify the amount in satoshis, ensuring precise and accurate financial transfers.

The Role of Miners

Miners validate transactions and add them to the blockchain. They compete to solve cryptographic puzzles, and the first to solve it gets to add a block of transactions to the blockchain and is rewarded with newly minted Bitcoin and transaction fees. These rewards are also denominated in satoshis, reinforcing their fundamental role in the Bitcoin ecosystem.

Challenges and Solutions

Network Congestion and Fees

As Bitcoin’s popularity grew, the network faced congestion, leading to higher transaction fees and slower confirmations. This congestion highlighted the need for solutions like the Lightning Network, which facilitates off-chain transactions in satoshis, alleviating the burden on the main blockchain.

Security and Reliability

The Lightning Network must maintain the security and reliability of the Bitcoin network while enabling faster transactions. To do this, it relies on smart contracts and multi-signature addresses to ensure that funds are only transferred when both parties agree. This mechanism preserves the integrity of transactions and protects against fraud.

Adoption and Integration

Widespread adoption of the Lightning Network and the use of satoshis requires integration with existing financial systems and user-friendly interfaces. Wallets, exchanges, and merchants must support Lightning Network transactions and display values in both BTC and sats. Educational efforts are also necessary to familiarize users with these concepts and encourage adoption.

Conclusion

Satoshis are a fundamental unit in the Bitcoin ecosystem, enabling precise and scalable transactions. Their integration with the Lightning Network addresses Bitcoin’s scalability issues, making it more practical for everyday use. As Bitcoin and the Lightning Network continue to evolve, the importance of sats will likely grow, further cementing their place in the future of digital finance. This integration supports Bitcoin’s original vision of being a peer-to-peer electronic cash system, accessible and useful to people worldwide.