The Big Shake-Up in Crypto Oversight

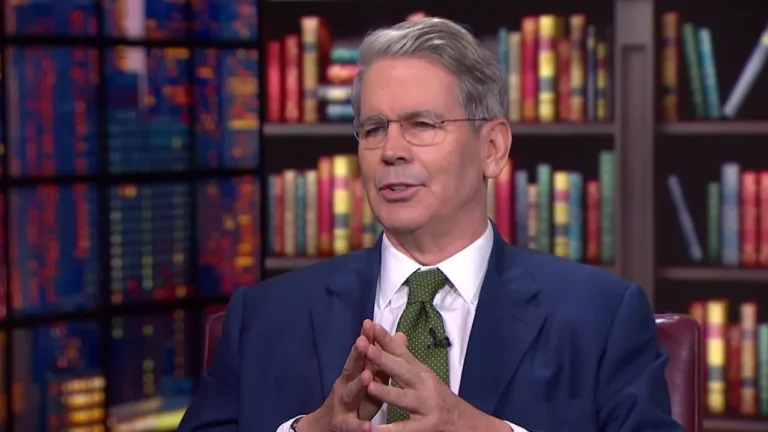

In a bold move that could reshape the way crypto is regulated in the U.S., President Trump has appointed Scott Bessent, his newly confirmed Treasury Secretary, as the temporary leader of the Consumer Financial Protection Bureau (CFPB)—an agency that has been keeping a close eye on crypto.

This is big news because the CFPB has been working on rules to control crypto and protect consumers from fraud, including a major interpretive rule last month. With Bessent at the helm, things could take a new direction—especially since he is known to be crypto-friendly and has spoken against a government-issued Central Bank Digital Currency (CBDC).

What Just Happened?

- Trump Fires CFPB Director – Over the weekend, Trump removed Rohit Chopra, the former CFPB Director, who was known for strict regulations on financial markets, including crypto.

- Bessent Takes Over – Scott Bessent, a billionaire hedge fund manager who recently became Treasury Secretary, is now also the acting head of CFPB.

- Crypto Regulations in Question – The CFPB has been working on rules to regulate digital payments like stablecoins. But with Bessent in charge, these rules might change.

- Elon Musk Joins the Battle – Musk, now co-leading a new government agency focused on efficiency, previously said he wanted to “delete” the CFPB.

Why Is This Important for Crypto?

- Bessent is pro-crypto – Unlike the previous CFPB leadership, he supports digital assets and might push for less restrictive regulations.

- Regulations could change – The CFPB was trying to apply old laws like the Electronic Fund Transfer Act (EFTA) to crypto, but now these rules might be reconsidered.

- CBDCs might be blocked – Bessent has spoken against a government-controlled Central Bank Digital Currency (CBDC), which some believe could threaten Bitcoin and other decentralized assets.

The Bigger Picture: Trump’s Strategy

- Consolidating Power – By putting Bessent in charge of both the Treasury and CFPB, Trump is centralizing control over financial regulations, possibly to weaken the CFPB’s influence.

- GOP vs. CFPB – The CFPB was created in 2011 by Senator Elizabeth Warren, a major crypto critic. Republicans have long wanted to reduce its power, and this move could be the first step.

- Crypto Policy in Flux – With Trump back in office, crypto policies are changing fast, and traders need to stay ahead of potential shifts in regulations.

Key Words to Remember

- Scott Bessent – New Treasury Secretary and temporary CFPB leader, known for supporting crypto.

- CFPB (Consumer Financial Protection Bureau) – U.S. agency focused on financial consumer protection, including crypto regulations.

- Interpretive Rule – A recent CFPB regulation aimed at protecting consumers from crypto fraud.

- Electronic Fund Transfer Act (EFTA) – An old financial law that the CFPB was trying to apply to crypto payments.

- CBDC (Central Bank Digital Currency) – A government-controlled digital currency, which Bessent and some Republicans oppose.

- Trump Administration’s Crypto Strategy – Shifting control of financial regulations and potentially making the U.S. more crypto-friendly.

What Should You Do Next?

- Follow Policy Updates – Keep an eye on what Bessent does next, as his decisions will impact crypto regulations.

- Watch for Market Reactions – If regulations loosen, crypto prices could rise. If there’s uncertainty, expect volatility.

- Stay Informed on CBDCs – If the U.S. moves away from a government-controlled digital currency, it could be bullish for Bitcoin and stablecoins.

Final Thought: A Crypto Revolution in the Making?

This power shift could mark a turning point for crypto regulation in the U.S. With a pro-crypto Treasury Secretary leading the financial watchdog, we could see a more open approach to digital assets. But with strong opposition from Democrats and regulatory agencies, expect a battle ahead.

For crypto traders and investors, this is a crucial moment—stay ahead, stay informed, and get ready for potential big moves in the market.