The U.S. Government is Looking Closer at Prediction Markets, and Coinbase Is Caught in the Middle. Here’s Why This Matters to You.

In the latest twist of the ongoing battle between the U.S. government and blockchain-based prediction markets, Coinbase, one of the largest crypto exchanges, has been subpoenaed by the U.S. Commodity Futures Trading Commission (CFTC). The investigation revolves around Polymarket, a platform where people bet on future events, such as elections or market movements. This is no small matter. In fact, it could shape the future of how platforms like Polymarket—and by extension, the cryptocurrency space—are regulated.

What’s Happening?

Coinbase has been served with a subpoena by the CFTC, which is seeking “general customer information” in connection with its investigation into Polymarket. If you’re a Coinbase user, you may have already received an email from them about the investigation, alerting you that your personal account data might be involved.

This isn’t the first time Polymarket has been under the government’s microscope. The platform has faced multiple legal challenges for offering betting products (like binary options) that allegedly violated U.S. financial laws. Polymarket has been forced to settle with the CFTC in the past, paying fines and making changes to its operations to comply with the law.

Why Should You Care?

- The Future of Crypto Regulations: The U.S. government is cracking down on prediction markets, especially those like Polymarket that allow U.S. citizens to place bets on real-world events. If the CFTC wins this case, it could set a precedent for how all crypto platforms are regulated moving forward. This could affect everything from how you trade to the kind of services you can access on exchanges like Coinbase.

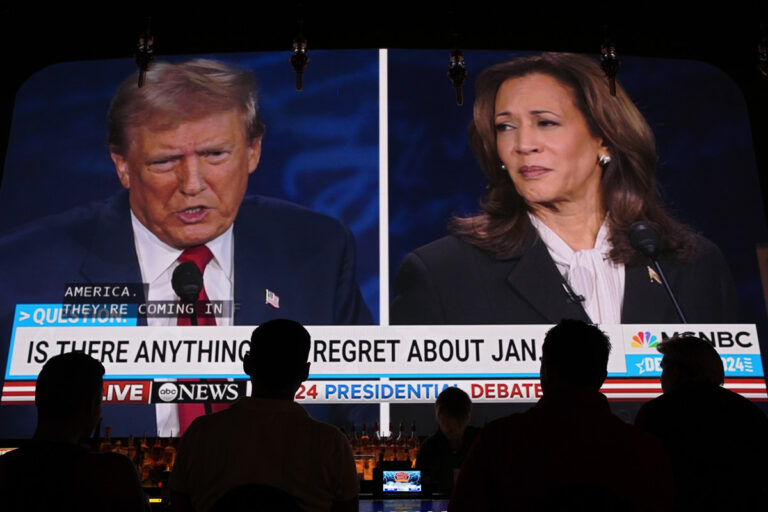

- Impacts on Platforms Like Polymarket: Polymarket’s rise in popularity, especially around major events like elections, has led to concerns about its potential to influence political outcomes. The CFTC is particularly sensitive to how these platforms might sway public opinion by allowing users to bet on election outcomes, which brings up questions of fairness and legality.

- Privacy Concerns for Users: With this subpoena, Coinbase is under pressure to hand over data that could include sensitive user information. While they assure customers that no immediate action is required on your part, the government’s ability to request personal information raises questions about privacy in the crypto world. How far can the government go when it comes to accessing your crypto data?

- Increasing Scrutiny on Crypto: This case is just one example of how regulators are paying more attention to crypto’s role in gambling, betting, and market speculation. As crypto continues to grow, regulatory bodies like the CFTC will likely continue to tighten their grip on these industries. If you’re involved in crypto—whether as an investor or a trader—you need to understand these developments and their implications for your future involvement in the space.

Key Terms to Remember:

- Subpoena: A legal order requiring someone to produce evidence or testify. In this case, Coinbase is being asked to provide customer information related to Polymarket.

- CFTC (Commodity Futures Trading Commission): The U.S. government body responsible for overseeing commodities and futures markets, including certain types of financial products offered by crypto platforms.

- Polymarket: A prediction market platform that allows users to bet on the likelihood of future events, like election outcomes or market trends. It has faced regulatory challenges in the past.

- Binary Options: A type of betting contract that pays out if a certain event happens or doesn’t happen, commonly used in financial markets.

- Geofencing: A technique used to limit access to a platform or service based on geographical location. In Polymarket’s case, it blocks U.S. users to comply with legal restrictions.

Why This is Important for You:

- Understanding the Legal Landscape: If you plan on working or investing in crypto long-term, understanding the legal issues surrounding platforms like Polymarket is crucial. Governments are getting more involved, and knowing the rules could save you from future legal headaches.

- Privacy in Crypto: The subpoena raises an important question about privacy. How secure is your data in the world of crypto? As governments push for more control, platforms like Coinbase may be forced to share data, which could put user privacy at risk.

- Future of Prediction Markets: The outcome of this investigation could have a lasting impact on how prediction markets operate in the future. If the CFTC continues to enforce strict regulations, it could change how prediction markets are designed and who can access them, possibly affecting your ability to use these platforms as you see fit.

Conclusion:

The CFTC’s investigation into Polymarket, and its subpoena of Coinbase, is a big deal for anyone involved in cryptocurrency. It’s a crucial reminder that, as crypto becomes more mainstream, it will attract increased regulation, which could affect everything from how you trade to how your personal information is handled. Understanding these developments now, while they’re still unfolding, will give you a head start in navigating this ever-evolving landscape.