The Big News:

In December 2024, something major happened in the world of cryptocurrency. Monthly trading volume on decentralized exchanges (DEXs) hit a new record, reaching an astonishing $320.5 billion. This number crushed the previous high of $299.6 billion set just the month before. In simpler terms, this shows that people are trading more on decentralized platforms than ever before. But what’s the real story behind this record, and why should you care?

Why is This Important?

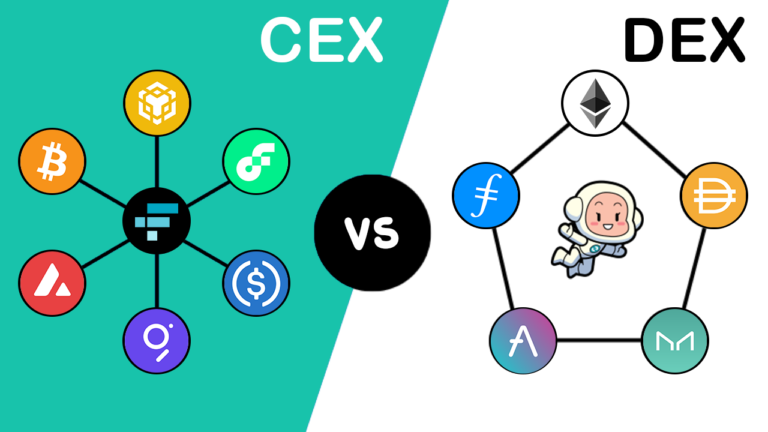

Imagine you’re in the middle of a huge market where everything happens fast—prices change, trends shift, and opportunities arise. The surge in DEX volume shows that more people are trusting these platforms to buy and sell their crypto without relying on traditional centralized exchanges (CEXs) like Binance or Coinbase. It’s a sign of growing confidence in decentralized finance (DeFi). This is massive because it shows that the future of crypto trading is leaning more towards decentralization, which offers more privacy, lower fees, and less control by big institutions.

This is something you need to understand because it might be where a large part of the crypto market is heading. Staying up-to-date on these trends could help you make better decisions when it comes to trading, investing, or even building projects in the crypto space.

Key Players in the Game

The report highlights the biggest players in the DEX space. Uniswap led the charge with a whopping $103 billion in volume, followed by PancakeSwap at $72 billion and Raydium with $54.6 billion. These platforms allow users to trade directly with each other, without needing to trust a third party.

This is where things get exciting—Uniswap, PancakeSwap, and Raydium are not just big names, they are the key to understanding how decentralized platforms are thriving. If you’re looking to dive into the future of trading, these platforms are your starting point.

CEXs Aren’t Slowing Down Either

But it’s not just decentralized exchanges making waves. Centralized exchanges (CEXs) like Binance and Crypto.com also saw huge volume increases in December. In fact, spot trading volume on centralized platforms surged to its highest level since May 2021, reaching $2.78 trillion, with Binance processing nearly $950 billion of that total.

The jump in CEX volume is also a sign that the market is heating up again. The reason behind this spike? A lot of it has to do with renewed interest in crypto markets, especially after political events like the reelection of Donald Trump, who’s known for being pro-crypto. More volatility and better trading tools have fueled a rise in trust, helping both DEXs and CEXs see more activity.

Why Should You Care?

- Increased Trust in DeFi: More people are putting their money into decentralized platforms. This means we’re moving closer to a future where cryptocurrencies and blockchain technology take over more traditional finance systems.

- Opportunities for You: Whether you’re into trading, investing, or even building projects, understanding these trends will give you an edge. The rise in decentralized trading shows a shift in market behavior, which could offer better ways to make profits.

- Future of Crypto: The surge in both DEX and CEX volume tells you that the crypto world is alive and evolving fast. Staying updated on these changes will help you navigate the market with confidence.

Key Words to Remember:

- DEX (Decentralized Exchange): A platform for trading crypto without a central authority.

- CEX (Centralized Exchange): Traditional exchanges like Binance where a central party controls the trades.

- Volume: The total amount of crypto being traded.

- DeFi (Decentralized Finance): Financial services that operate without intermediaries like banks.

- Liquidity: The ease with which assets can be bought or sold without affecting their price.

The Takeaway

The fact that DEX volume reached an all-time high isn’t just a statistic—it’s a clear signal that decentralized platforms are taking the lead in the crypto space. As more people trust these platforms for their trades, this could mark a huge shift in how cryptocurrency is used globally. By understanding these developments, you’re not just following the crowd, you’re positioning yourself to be ahead of the curve in an industry that’s only getting bigger and more influential.

This is the kind of knowledge that can shape your decisions in the crypto world, whether you’re looking to trade, invest, or build the next big thing.