Hook: How did Bitcoin ETFs, stablecoins, Solana, SocialFi, and prediction markets redefine crypto in 2024? Dive into the biggest highlights that could set the stage for the future of blockchain!

What’s the Big Idea?

2024 wasn’t just another year for crypto—it was a game-changer. Five trends stood out and reshaped how people see and use cryptocurrency. From new highs in Bitcoin and stablecoins to the rise of Solana in DeFi and the evolution of SocialFi, these developments weren’t just numbers; they signaled where crypto is heading and why it matters.

1. Bitcoin ETFs: The New Superstar

Key Idea: For years, people wanted Bitcoin ETFs (exchange-traded funds) in the U.S. The wait ended in 2024, with Bitcoin ETFs breaking records and attracting billions.

Why It Matters:

- Steps:

- The U.S. SEC approved 11 Bitcoin ETFs, including big names like BlackRock and Fidelity.

- Bitcoin ETFs saw over $35 billion in investments, showing Wall Street’s confidence in crypto.

- BlackRock’s ETF alone brought in $37 billion, dominating the market.

Key Words: Bitcoin ETF, BlackRock, SEC approval, inflows.

Takeaway: Bitcoin’s price soared toward $100,000, proving how mainstream adoption can ignite a market.

2. Stablecoins: The Quiet Powerhouse

Key Idea: Stablecoins (crypto tied to the U.S. dollar) hit a record supply of over $200 billion, rivaling giants like Visa in transaction volume.

Why It Matters:

- Steps:

- Major firms like PayPal launched their own stablecoins.

- Governments debated stablecoin regulations, with some stablecoins holding U.S. Treasuries.

- Tether (USDT) dominated the market with $140 billion in supply.

Key Words: Stablecoin, PayPal, USDT, U.S. Treasuries.

Takeaway: Stablecoins are no longer just a crypto tool; they’re becoming vital for global finance.

3. Solana Takes Over DeFi

Key Idea: Solana led a resurgence in decentralized finance (DeFi), with low fees and high activity pushing it ahead of Ethereum in certain areas.

Why It Matters:

- Steps:

- DeFi fees soared to $893 million in December, with Solana contributing the most.

- Platforms like Raydium and Jito hit record highs in transaction fees.

- Solana’s price climbed past $263, showing its strength.

Key Words: Solana, DeFi, transaction fees, Ethereum.

Takeaway: Solana’s speed and low costs make it a favorite for DeFi users, signaling its growing importance.

4. SocialFi: Rise and Fall

Key Idea: SocialFi, which combines social media with blockchain, had a promising start but struggled to keep its momentum.

Why It Matters:

- Steps:

- Platforms like friend.tech rewarded users for content but couldn’t sustain interest.

- Farcaster, another SocialFi app, peaked with 75,000 daily users but declined afterward.

- Despite the hype, SocialFi remains a work in progress.

Key Words: SocialFi, friend.tech, Farcaster, user rewards.

Takeaway: SocialFi’s future depends on finding long-term value beyond trends.

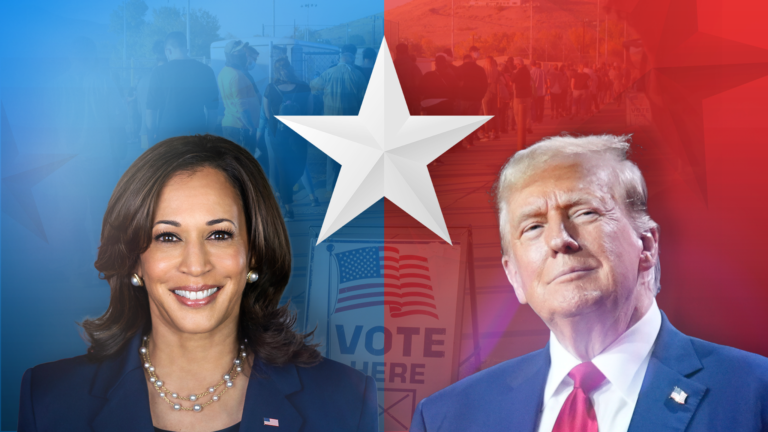

5. Polymarket and the U.S. Election Frenzy

Key Idea: Polymarket, a decentralized betting platform, surged during the U.S. presidential election, breaking records in trading volume.

Why It Matters:

- Steps:

- Polymarket allowed people to bet on outcomes like the presidential race.

- Over $5 billion was traded in October and November alone.

- Active traders reached an all-time high, showing growing interest in blockchain-based predictions.

Key Words: Polymarket, prediction markets, U.S. election, trading volume.

Takeaway: Decentralized prediction markets could revolutionize how we analyze and interact with future events.

Why This is Important for You

Understanding these trends isn’t just about numbers; it’s about seeing the bigger picture. These events show how crypto is evolving into a mainstream financial system. If you want to build knowledge in crypto:

- Watch ETFs: They show Wall Street’s growing trust in Bitcoin.

- Follow Stablecoins: They’re proving to be crypto’s “killer app.”

- Explore DeFi: Platforms like Solana are changing how we think about finance.

- Think Beyond Trends: SocialFi teaches us that hype isn’t enough—it’s about long-term value.

- Learn About Prediction Markets: Platforms like Polymarket show the real-world potential of blockchain.

Final Thought: Crypto isn’t just a passing trend—it’s becoming a cornerstone of finance, technology, and society. 2024’s milestones set the stage for even bigger changes in 2025 and beyond. Stay curious, keep learning, and don’t miss your chance to be part of this revolution!