Hook: The clash between centralized and decentralized exchanges is heating up. But is there room for both to thrive in the ever-changing world of cryptocurrency?

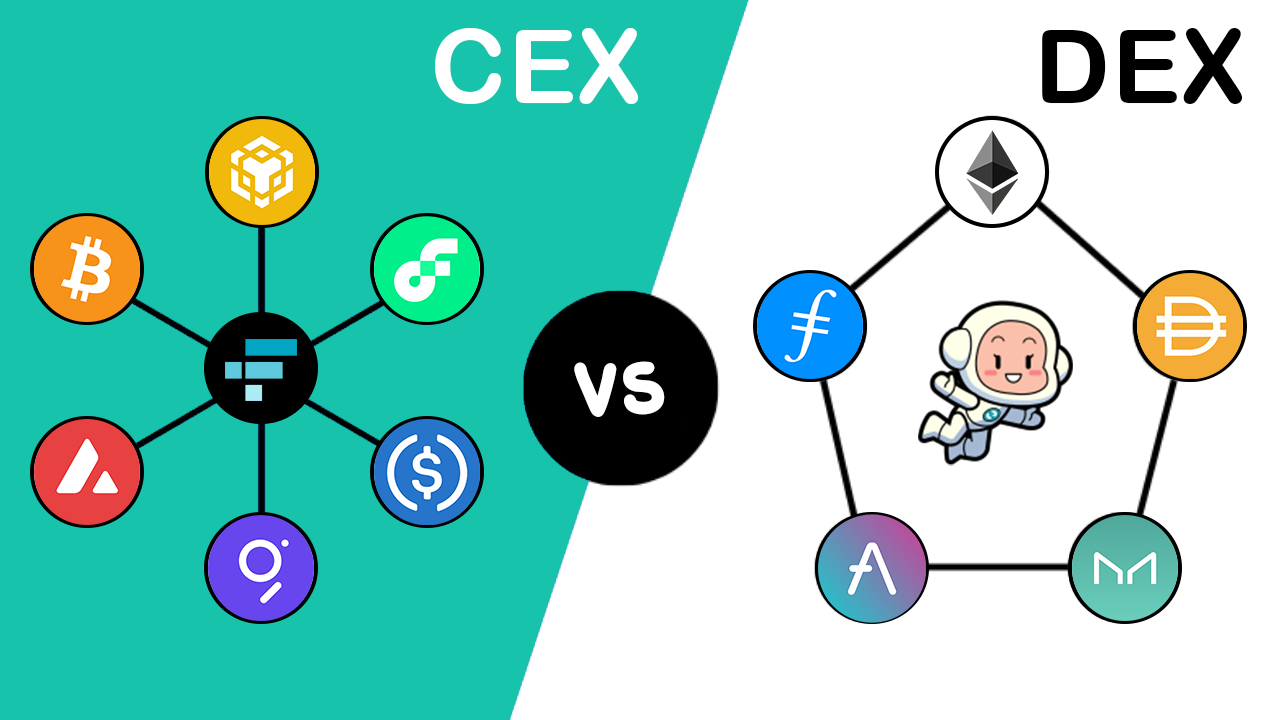

In the rapidly evolving world of cryptocurrency, exchanges are the main bridges between the crypto world and traditional finance. Two major types dominate this space: Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs). They have different strengths, but the real question is: Can they coexist, or is one destined to outshine the other?

The Growth of Decentralized Exchanges (DEXs)

In November 2024, DEX volumes hit an all-time high of $300 billion, surpassing previous records. This shows that decentralized trading is becoming more popular, with the volume ratio between DEXs and CEXs rising steadily. For example, in early 2020, DEX volume made up only 0.04% of the total market share, but by November 2024, it reached 11%. This shows a dramatic rise in decentralized trading.

But despite their growth, DEXs still account for a small share of the market compared to centralized exchanges. So, can they exist together, or will one model dominate the other?

Why Centralized Exchanges (CEXs) Aren’t Going Anywhere

CEXs, like Binance and Coinbase, dominate the market because they offer better liquidity and a more user-friendly experience. This makes them appealing to both retail traders and institutional investors. Their centralized nature allows for easier control over the exchange, including offering customer support and reliable trade execution.

Gracy Chen, CEO of Bitget, points out that CEXs are better suited for retail and institutional customers who need a smooth, reliable experience. On the other hand, DEXs appeal to DeFi enthusiasts, professionals, and traders who are looking for tokens not available on CEXs. So, while both models serve different groups of people, they have different niches to fill.

The Regulatory Threat and Its Impact on Platforms

Regulation is becoming one of the most powerful forces shaping the future of both types of exchanges. Luuk Strijers, CEO of Deribit, warns that regulatory pressures could force many smaller platforms to shut down or become unsustainable. With increasing regulations, only the strongest platforms, those that comply with the rules, will survive. This means that exchanges must adapt to stricter laws, or they will fade away.

Strijers believes that global regulation will become even stricter, and only a few top exchanges will be able to handle the pressure. This suggests a massive shift toward fewer, larger platforms that can afford the costs of compliance.

The Future: Complementary or Competitive?

The big question is: Will CEXs and DEXs continue to coexist, or will one eventually dominate? Gracy Chen believes that both can survive, but CEXs will likely continue to lead the market due to their stronger user experience and liquidity. However, DEXs will still hold their place in niche markets where users prioritize decentralization and privacy.

The Role of Liquidity and Institutional Adoption

As more institutional investors enter the market, liquidity becomes key. The ability to trade with high liquidity will continue to be a major factor for exchanges, especially for institutional investors who need to execute large trades quickly. Alain Kunz from GSR highlights the challenge that DeFi platforms face in attracting institutional investors because they lack the ability to verify counterparts in trades, which is crucial for many regulated firms.

The future of DeFi (Decentralized Finance) will depend on whether these platforms can scale up and integrate with traditional finance. If DeFi platforms can evolve to meet these needs, they could become more attractive to institutions, despite the current regulatory hurdles.

Why This Is Important for You

Understanding the dynamics between CEXs and DEXs is essential for anyone involved in crypto trading or investment. The cryptocurrency market is changing rapidly, with regulations and institutional adoption playing significant roles in shaping the landscape. By staying informed, you can position yourself to make better decisions about which platforms to use and which projects to invest in.

Key Takeaways:

- Decentralized exchanges are growing, but centralized exchanges remain dominant due to better liquidity and user experience.

- Regulation will continue to shape the future of both CEXs and DEXs, with only the most secure and compliant platforms thriving.

- Institutional adoption of crypto is increasing, and liquidity will be key in attracting these investors.

- The debate on whether CEXs and DEXs can coexist is ongoing, but both will continue to play important roles in different niches.

By staying ahead of these changes, you’ll be better prepared to understand how the crypto market is evolving and how you can take advantage of new opportunities as they arise.