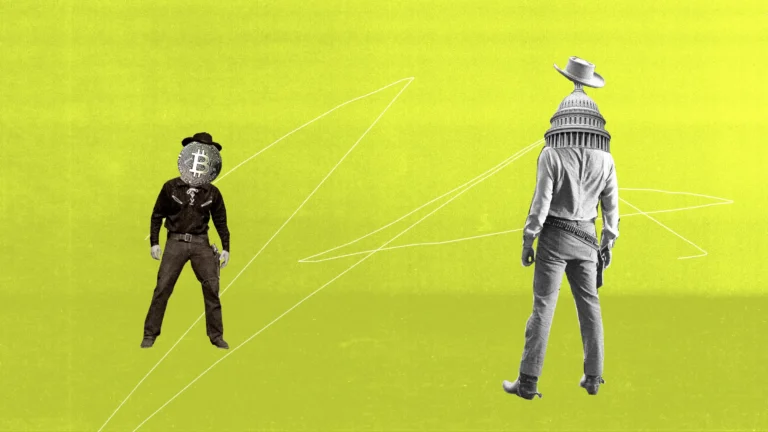

The battle for crypto’s future takes a major turn as the SEC faces a legal setback. But what does this mean for the industry?

In a monumental legal twist, the United States District Court recently struck down the U.S. Securities and Exchange Commission’s (SEC) controversial “broker-dealer” rule, marking a significant victory for the crypto industry. The SEC had proposed a sweeping rule change that would redefine what it means to be a “dealer” in the financial world, with the aim of increasing oversight over cryptocurrency projects. But the court disagreed, calling the SEC’s interpretation of the law “too broad” and beyond its legal authority.

The Core of the Dispute

The SEC’s new rule aimed to expand the definition of a “dealer” to include any entity providing liquidity or market-making services (like automated systems for trading), but only if they controlled more than $50 million in capital. The rule would have forced many crypto platforms, especially decentralized ones, to comply with strict financial regulations that would be difficult—or even impossible—for them to meet.

For example, decentralized networks, which are by design without central control, wouldn’t have the infrastructure to enforce “Know Your Customer” (KYC) or “Anti-Money Laundering” (AML) rules that traditional financial systems do. This change in the law was seen as a major threat to the growth and innovation of the crypto industry in the U.S.

Why Is This Important?

- Decentralized Projects Get a Break: The court ruling is a huge win for decentralized crypto projects that would have been unable to meet these tough regulations. These projects, which allow peer-to-peer transactions without central authorities, have often clashed with regulatory bodies trying to apply old rules to new tech.

- Regulatory Overreach: The SEC’s rule was seen by many as an overreach—an attempt to impose outdated regulations on cutting-edge technology. Legal experts, crypto advocates, and even SEC commissioners themselves voiced concerns that the rule was far too broad, making it harder for innovators to thrive.

- Legal Precedent for Crypto: This ruling sets an important legal precedent, affirming that regulators can’t just impose blanket rules on emerging industries without considering their unique characteristics. It shows that courts are willing to push back when agencies overstep their authority.

Key Terms to Remember:

- Broker-dealer rule: A legal definition used by the SEC to regulate entities involved in buying and selling securities. The recent rule would have redefined this to include many crypto players.

- Liquidity providers: Companies or systems that ensure there’s enough buying and selling activity in the market.

- Decentralized networks: Platforms like decentralized exchanges (DEXs) that operate without a central authority.

- KYC (Know Your Customer) and AML (Anti-Money Laundering): Rules that require financial institutions to verify the identity of their users and report suspicious activities.

What’s Next?

While this is a big win for crypto, it’s not the end of the road. The SEC still has the option to appeal the decision to a higher court, which means this legal battle could continue. The industry, however, sees this as a sign of hope—proof that the legal system is starting to recognize the unique nature of crypto and the need for reasonable regulation.

Why Should You Care?

As a young person interested in crypto, this development is a sign that the industry’s legal landscape is evolving. The way that courts are pushing back against overreaching regulations could open up more opportunities for innovation. If you’re into crypto or planning to get involved, understanding these legal shifts is crucial—it will impact everything from the projects you invest in to the platforms you use. The battle for the future of crypto is just beginning, and staying informed gives you a better chance to navigate this exciting, but challenging, space.