A New Era for Crypto: Why the Surge in Exchange Traffic Matters

The month of October saw a significant 8% increase in traffic to the top 20 cryptocurrency exchanges, a sign of growing investor interest in the crypto market. This surge is important because it indicates that more people are getting involved in cryptocurrency, and this shift could lead to further market growth and price increases. Let’s break this down and understand why this is crucial for you to know.

What’s Happening?

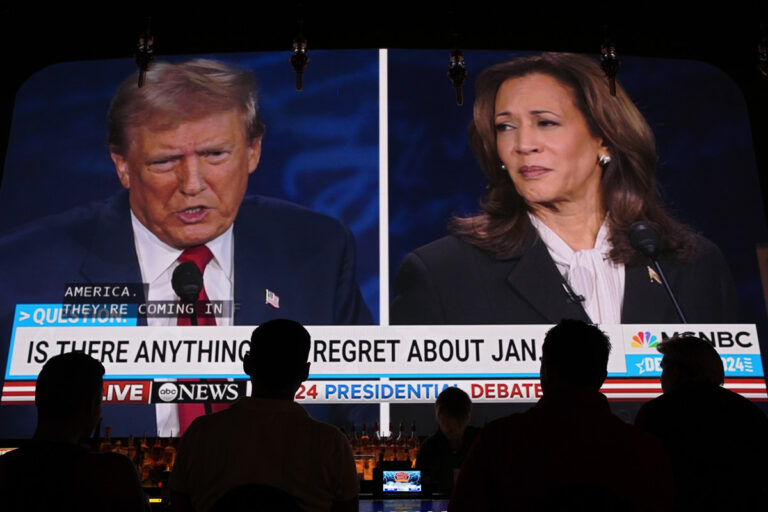

The boost in web traffic to these crypto exchanges is tied to the upcoming 2024 U.S. elections, where a pro-crypto president and lawmakers have started drawing attention to the cryptocurrency space. People are getting excited about the potential for more favorable regulations and policies in the future, which is encouraging more retail investors to jump in.

Key exchanges like Binance, WhiteBit, and Coinbase have seen massive traffic, with 54 million, 33 million, and 30 million visits, respectively. This shows that big players in the crypto world are becoming more popular, and more people are visiting these platforms to explore trading and investment opportunities.

Why Does This Matter to You?

- More Interest = More Opportunity: As more people get involved in crypto, the market becomes more liquid and active. This can create new opportunities for traders and investors to make profits.

- Seasonal Market Movements: There’s a term called “Uptober,” referring to how crypto markets often rally in October after a slow summer. The rise in traffic suggests that people are expecting price increases, and they’re positioning themselves to benefit from this potential rally.

- Impact of the Elections: The U.S. elections play a big role here. The election of a pro-crypto president could mean that there will be better policies for crypto in the future, which would lead to more stable market growth. This is why people are paying so much attention to this election.

Key Terms to Remember:

- “Uptober”: A term used by traders to describe the increase in crypto market activity that typically happens in October after a summer of sideways trading.

- Web Traffic to Exchanges: This is a measure of how many people are visiting crypto exchanges, and it shows the level of interest in the market.

- Open Interest: Refers to the number of outstanding contracts in a market. More open interest in Bitcoin futures shows that traders are betting on future price movements, which can drive price action.

- Stablecoin Inflows: When more money is flowing into stablecoins (digital currencies that are pegged to traditional assets like the U.S. dollar), it’s a sign that traders are preparing for future market moves, including price increases in Bitcoin and other cryptocurrencies.

What’s Next?

As the elections unfold, the market is seeing a shift in investor sentiment. The price of Bitcoin is reaching new all-time highs, and indicators suggest that this rally could continue. Bitcoin ETFs are seeing huge trading volumes, and even Ethereum is getting more attention, with Ether’s price breaking above $3,000.

This increased interest and market activity show that the crypto world is in a phase of rapid growth. For you, understanding these trends is crucial because it could mean new opportunities for investment and trading. Being informed and staying ahead of these shifts could put you in a strong position to profit from the ongoing crypto market expansion.

Why Should You Care?

As a young investor or trader, understanding these market dynamics will help you make better decisions. If you’re paying attention to the surges in web traffic, the impact of major elections, and the behavior of stablecoins and futures markets, you’re positioning yourself to understand the big picture of the crypto market. This knowledge could help you predict trends, seize opportunities early, and increase your chances of success in the crypto space.