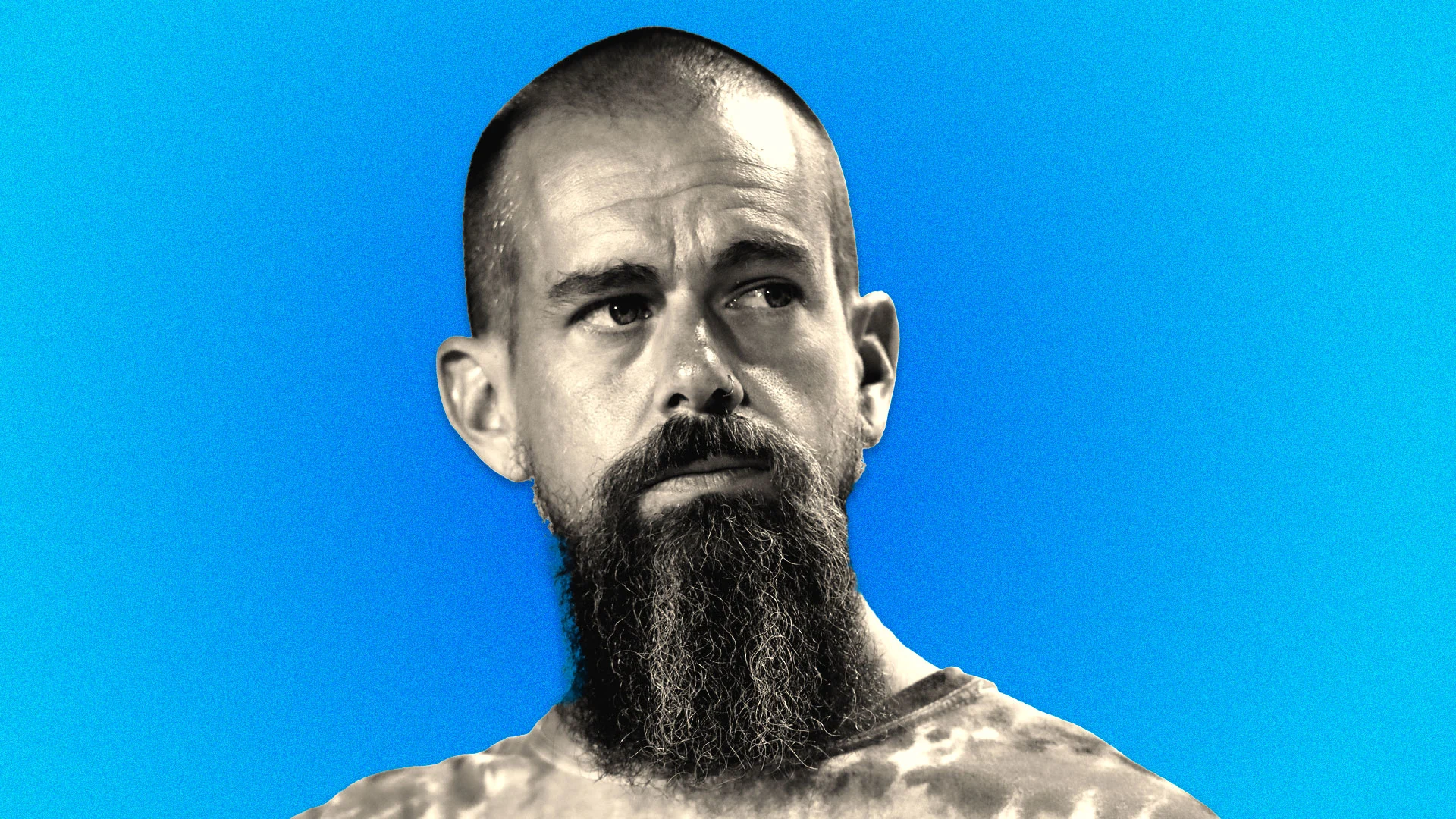

Hook: Imagine the tech world as a battleground, and Jack Dorsey—yes, the guy who co-founded Twitter—is suiting up for war. But instead of wielding tweets, he’s going all-in on Bitcoin mining. This move isn’t just about chasing profits; it’s about reshaping the digital frontier. Why should you care? Because understanding this could be your key to the future of money and tech.

1. What’s Happening?

Jack Dorsey’s company, Block (formerly known as Square), is pivoting hard toward Bitcoin mining. This isn’t a random gamble—it’s a calculated play to make the U.S. a global leader in Bitcoin production. Here’s what they’re doing:

- Investing More in Bitcoin Mining: They’ve developed advanced three-nanometer mining chips, designed to make Bitcoin mining faster and more efficient.

- Partnering with Industry Giants: Block has teamed up with Core Scientific, a major player in the mining world, to deploy these chips on a massive scale.

- Shutting Down Non-Bitcoin Projects: To focus on Bitcoin, Block is scaling back on other ventures like the music app Tidal and TBD, its decentralized web initiative.

2. Why Is This Important?

Here’s where it gets exciting—and why you should pay attention.

Bitcoin Mining: The Future of Finance

Bitcoin mining isn’t just about creating digital coins. It’s about securing a decentralized financial system that could one day replace traditional banking. By focusing on mining, Block is helping to strengthen this system, making it more resilient and independent from government control.

- Keyword: Decentralization – This means no single entity (like a government or big bank) has control. Instead, power is distributed across a global network.

- Keyword: Self-Custody – Tools like Block’s Bitkey wallet let you hold your own Bitcoin securely, without relying on a third party like a bank.

Aligning with U.S. Policy

Block’s strategy aligns with political moves, like Donald Trump’s push to make the U.S. a Bitcoin mining powerhouse. If successful, this could solidify America’s dominance in the crypto space, influencing everything from tech innovation to global financial policy.

3. The Risks and Rewards

Not everything is smooth sailing. Block’s Q3 revenue fell short of expectations, causing a temporary stock dip. But here’s the thing: Dorsey is playing the long game.

- Short-Term Pain for Long-Term Gain: By doubling down on Bitcoin now, Block is positioning itself to ride the wave as crypto becomes more mainstream.

- Keyword: Market Fit – Block’s mining products already have strong demand, signaling this isn’t just a hunch—it’s a calculated business strategy.

4. Why This Matters to You

You’re 20. You’ve got decades ahead in a world where Bitcoin and decentralized tech could reshape everything—from how you save money to how you interact online. By understanding these moves now, you’ll be ahead of the curve in:

- Investing Smartly: Knowing where companies like Block are headed helps you spot opportunities early.

- Adapting to Change: As the world shifts to decentralized systems, being tech-savvy could give you a major edge in your career.

Final Thought

Jack Dorsey isn’t just pivoting a company; he’s shaping the future. Whether you dream of becoming a tech innovator, an investor, or just someone who gets it, this is your chance to learn. The world of finance and tech is changing fast—understanding moves like Block’s gives you the power to grow with it.