What’s the story?

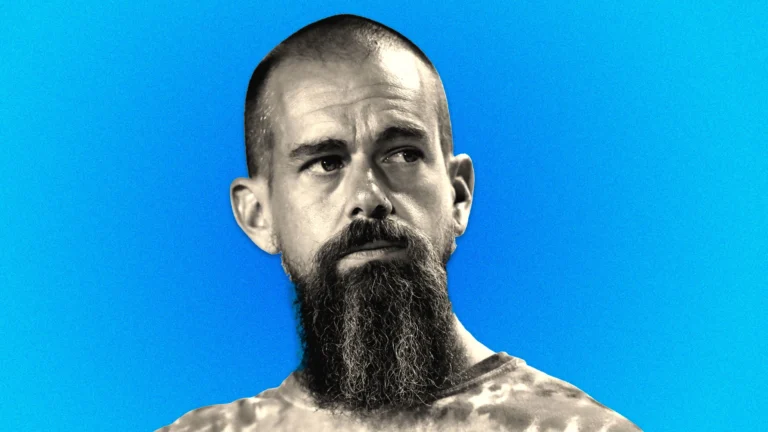

Jack Dorsey’s Block (formerly Square) is making waves in the financial tech world. Recently, JPMorgan analysts gave it an Overweight rating. Translation? They think Block’s stock is going to crush it compared to others in its industry. But here’s the catch: Block’s forecast for the last quarter of 2024 wasn’t exactly a jaw-dropper. So, why is JPMorgan still so bullish? Let’s break it down.

The Good Stuff: Block’s Winning Streak

1. Solid Q3 Performance

Block’s third-quarter (Q3) earnings were 🔥. They pulled in $2.25 billion in gross profit—a 19% jump compared to last year. This growth wasn’t a fluke. It came from two of Block’s superstar products:

- Square: Their bread-and-butter tool for small businesses, handling everything from card payments to inventory.

- Cash App: Your go-to for peer-to-peer money transfers, investing, and even buying Bitcoin.

Key term to remember: Gross Profit—This is the money a company keeps after covering the costs to make or sell its products. Block’s gross profit shows it’s not just growing; it’s growing efficiently.

The Not-So-Great: A Bumpy Q4 Ahead

Here’s where things get tricky. Block is lowering its expectations for Q4 (October-December). Why? Some of the benefits they were hoping for this year—like revenue boosts from new products—won’t show up until 2025.

JPMorgan called this a “negative surprise.” But they’re not panicking. Why? Because Block’s long-term vision still looks rock solid.

Why JPMorgan is Still Excited About 2025

Even though Q4 might be a bit underwhelming, Block’s future plans are what’s keeping investors excited. Let’s highlight a few:

- Square’s Growth Potential: They expect Square’s Gross Payment Volume (GPV)—that’s the total value of transactions processed—to keep climbing.

- Bitcoin Focus: Block is doubling down on crypto. Two key initiatives here are:

- Bitcoin Mining: They’re working on making Bitcoin mining more accessible and energy-efficient.

- Bitkey: A self-custody Bitcoin wallet that puts more control in the hands of users.

Key term to remember: Gross Payment Volume (GPV)—This is the total amount of money flowing through a payment system. The bigger this number, the more cash Square is handling for businesses, which is great for Block’s bottom line.

Sacrifices for the Crypto Vision

To push its Bitcoin ambitions, Block is cutting back in other areas. One notable example? TIDAL, the music streaming service they own. Another is their decentralized web projects. While these are cool, they’re not as core to Block’s mission right now as crypto is.

Why This Matters for You

Now, you’re probably wondering: Why should I care about a company like Block? Here’s why:

- The Future of Finance: Companies like Block are leading the charge in reshaping how we handle money—whether it’s small businesses using Square or individuals managing crypto with Cash App and Bitkey.

- Investing Smarts: Understanding why big players like JPMorgan back certain stocks gives you insight into what makes a company valuable. It’s not just about short-term wins (like Q4 earnings); it’s about the long game.

- Crypto’s Role in the Economy: Block’s focus on Bitcoin shows how intertwined crypto is becoming with mainstream finance. If you’re into crypto, knowing how big firms like Block operate helps you see where the market is headed.

The Takeaway

Block is a company that’s taking risks, and while not all of them pay off immediately, the ones that do could reshape the future of payments and crypto. For you, staying ahead in the tech and finance world means understanding these moves and what they could mean for your investments and career.