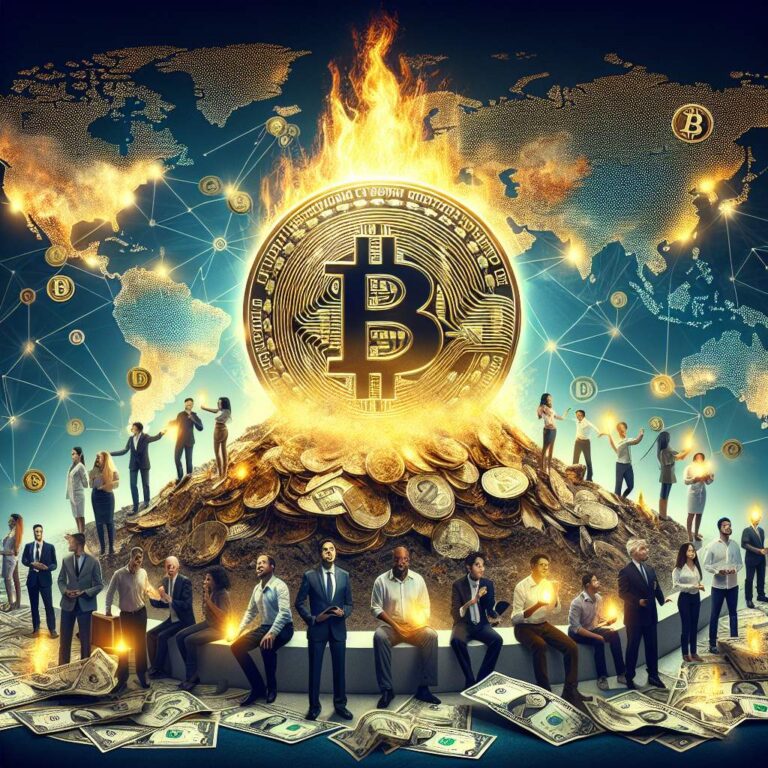

Hook: Imagine living in a world where a few people get richer and richer by holding Bitcoin, while the rest of society struggles to keep up. Sounds unfair, right? According to European economists, this could become reality if Bitcoin’s price keeps rising forever.

In a recent paper, economists from the European Central Bank (ECB) argue that if Bitcoin’s price keeps skyrocketing, it will mostly benefit early adopters—the people who bought Bitcoin first—and leave latecomers and those who don’t own any, much worse off. They say this growing gap in wealth could hurt society, leading to instability and even threatening democracy. But how is that possible?

The Broken Dream of Bitcoin

Bitcoin started with a dream: Satoshi Nakamoto, its mysterious creator, wanted it to be a global payment system, a digital currency for everyone. But that vision, according to these economists, didn’t really work out. Instead of being a new form of money for everyday transactions, Bitcoin has turned into an investment. People now buy Bitcoin hoping its price will rise so they can sell it later for a profit.

A Zero-Sum Game: The Rich Get Richer

This is where things get tricky. The economists argue that Bitcoin doesn’t create any real value like other assets do. Think about real estate—you can live in it or rent it out to make money. Or stocks—they pay dividends, which means you get some profit from the company. Bitcoin, on the other hand, doesn’t produce anything. It’s only valuable because people believe its price will go up.

This turns Bitcoin into a zero-sum game—a situation where one person’s gain is another person’s loss. The early Bitcoin investors, the ones who bought it when it was cheap, make huge profits by selling it to newcomers. But the people who buy Bitcoin later are taking a bigger risk. If Bitcoin’s price keeps going up, the rich early adopters get richer, and those latecomers might lose out or never catch up.

Why It Matters

Now, this is where the story gets really interesting and a bit scary. The ECB economists warn that this growing wealth gap could lead to societal problems. If only a few people profit while the rest get left behind, it could harm social cohesion (people feeling united as a society) and cause frustration, instability, and even undermine democracy. Imagine a world where you’re struggling financially while others are buying luxury cars and villas just because they got into Bitcoin early.

According to the paper, the real danger isn’t just that you’ll “miss out” on making money from Bitcoin—it’s that society as a whole could become poorer, which could lead to serious consequences like political instability.

What Should We Remember?

- Early Adopters Benefit: People who bought Bitcoin early could profit hugely, but latecomers and non-holders might face losses.

- Zero-Sum Game: Bitcoin doesn’t create new value; one person’s gain is another person’s loss.

- Impoverishment Risk: A society where wealth is concentrated among a few could lead to instability and threaten democracy.

- Failed Vision: Satoshi’s dream of Bitcoin as a global payment system didn’t come true; now, it’s more like a speculative investment.

The Bigger Picture

This article highlights the growing debate about Bitcoin’s role in society. Some see it as a revolutionary technology, while others, like these economists, warn that it could lead to big problems for the majority of people. By understanding both sides, you’ll gain deeper knowledge of how Bitcoin works and its impact on the world around us. It’s not just about making money—it’s about recognizing the bigger consequences of how wealth is distributed in society.