In an era where information is power, prediction markets are emerging as a new frontier in understanding and forecasting significant events, particularly the upcoming U.S. presidential elections. A recent surge in betting on these decentralized platforms highlights their potential to offer insights that traditional polling methods may struggle to provide.

What Are Prediction Markets?

Prediction markets are platforms where people can place bets on the outcomes of future events, such as elections. Participants use cryptocurrencies, particularly stablecoins like USD Coin (USDC), to stake their predictions. This system operates under the belief that collective knowledge and financial incentives can lead to more accurate forecasts than conventional polls.

Why Did They Skyrocket in Q3?

In the third quarter of 2024, the volume of bets on prediction markets exploded by an astonishing 565.4%, reaching $3.1 billion. This boom can be largely attributed to the looming U.S. presidential elections, prompting individuals to place bets on candidates and potential outcomes. The most notable platform leading this trend is Polymarket, which commands a whopping 99% market share in this space.

Key Figures to Remember

- $3.1 billion: Total betting volume in Q3 2024.

- 565.4%: The growth rate of prediction markets in Q3 compared to the previous quarter.

- Polymarket: The dominant player, accounting for over 99% of the market share.

- $1.7 billion: Amount bet on the U.S. presidential election on Polymarket alone.

The Advantages Over Traditional Polling

Billionaire Elon Musk has suggested that these decentralized prediction markets could offer a more accurate reflection of public sentiment regarding election outcomes than traditional polling systems. Traditional polls often rely on a small sample size and may not capture the full spectrum of public opinion, while prediction markets aggregate the predictions of many participants, reflecting real-time sentiments and trends.

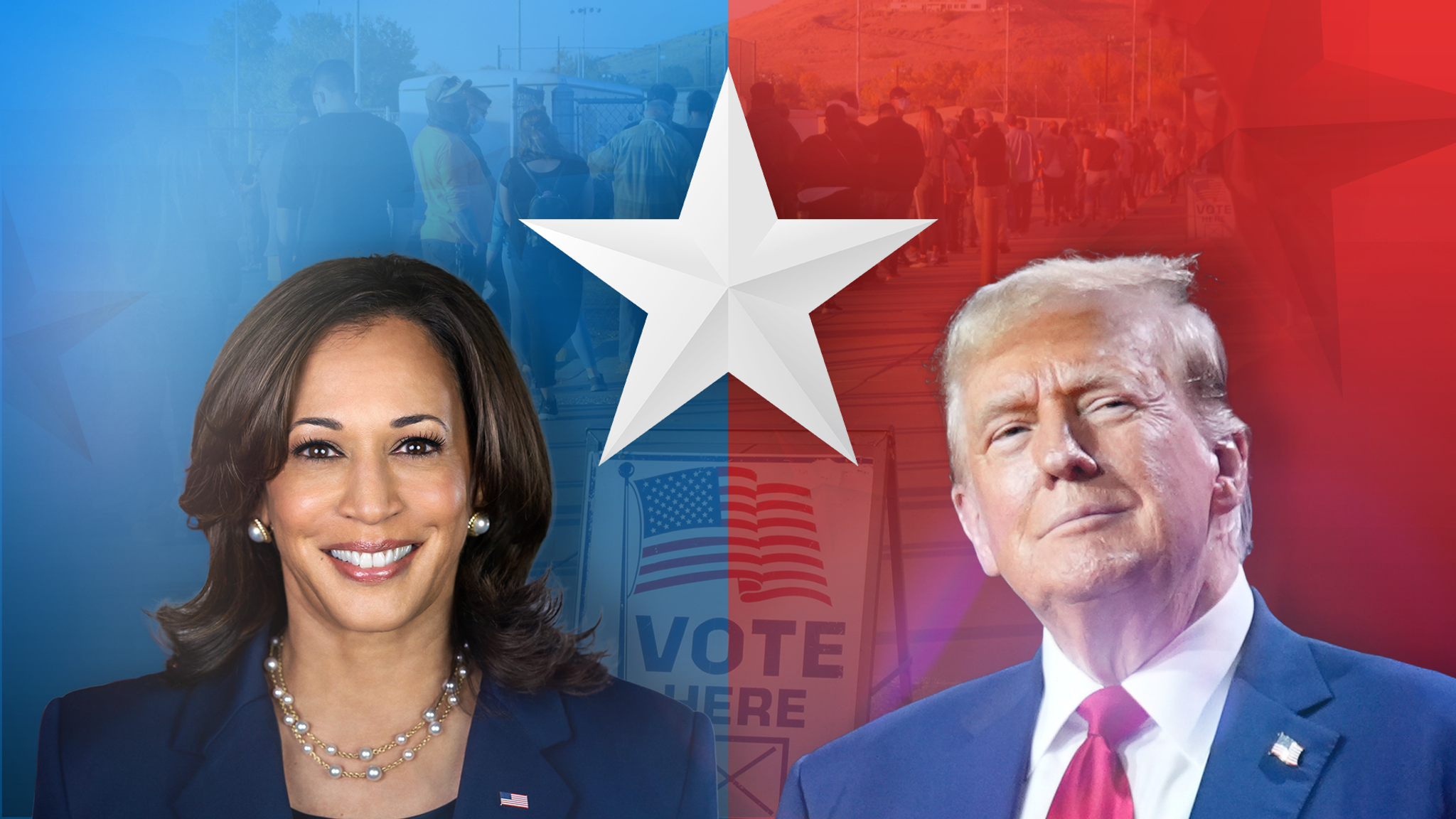

Current Election Dynamics

As of mid-October, prediction market data shows former President Donald Trump leading with a 53.8% chance of winning, compared to 45.3% for Vice President Kamala Harris. The momentum appears to be shifting in Trump’s favor, illustrating how fluid and dynamic these predictions can be based on new information and market sentiment.

Why Is This Important for You?

Understanding prediction markets is crucial as they represent a blend of finance, technology, and data analytics—key areas that are rapidly evolving. By grasping how these markets operate, you can gain insights into the political landscape, make informed decisions regarding investments, and potentially leverage these platforms for financial gain.

Steps to Build Your Knowledge

- Research More: Dive deeper into how prediction markets work, including the mechanics behind staking and odds calculation.

- Follow Market Trends: Keep an eye on platforms like Polymarket to understand how betting volumes change with news and events.

- Explore Real-World Applications: Consider how similar models could apply in other areas beyond politics, like sports or economics.

- Stay Informed: Regularly read articles and reports on prediction markets and their implications in various fields.

Key Terms to Remember

- Decentralized Prediction Markets: Platforms where users bet on outcomes without centralized control.

- Stablecoins: Cryptocurrencies pegged to traditional currencies, reducing volatility in betting.

- Total Value Locked (TVL): A metric indicating the total amount of assets held within a platform, reflecting its popularity and trustworthiness.

- Market Share: The percentage of an entire market controlled by a single platform, highlighting dominance.

Conclusion

The rise of prediction markets like Polymarket signals a significant shift in how we gauge public sentiment and predict outcomes in uncertain scenarios. As they continue to gain traction, staying informed and understanding these platforms will not only enhance your knowledge but could also provide opportunities for personal and financial growth. Embracing this knowledge is essential for anyone looking to navigate the increasingly complex world of finance and technology.