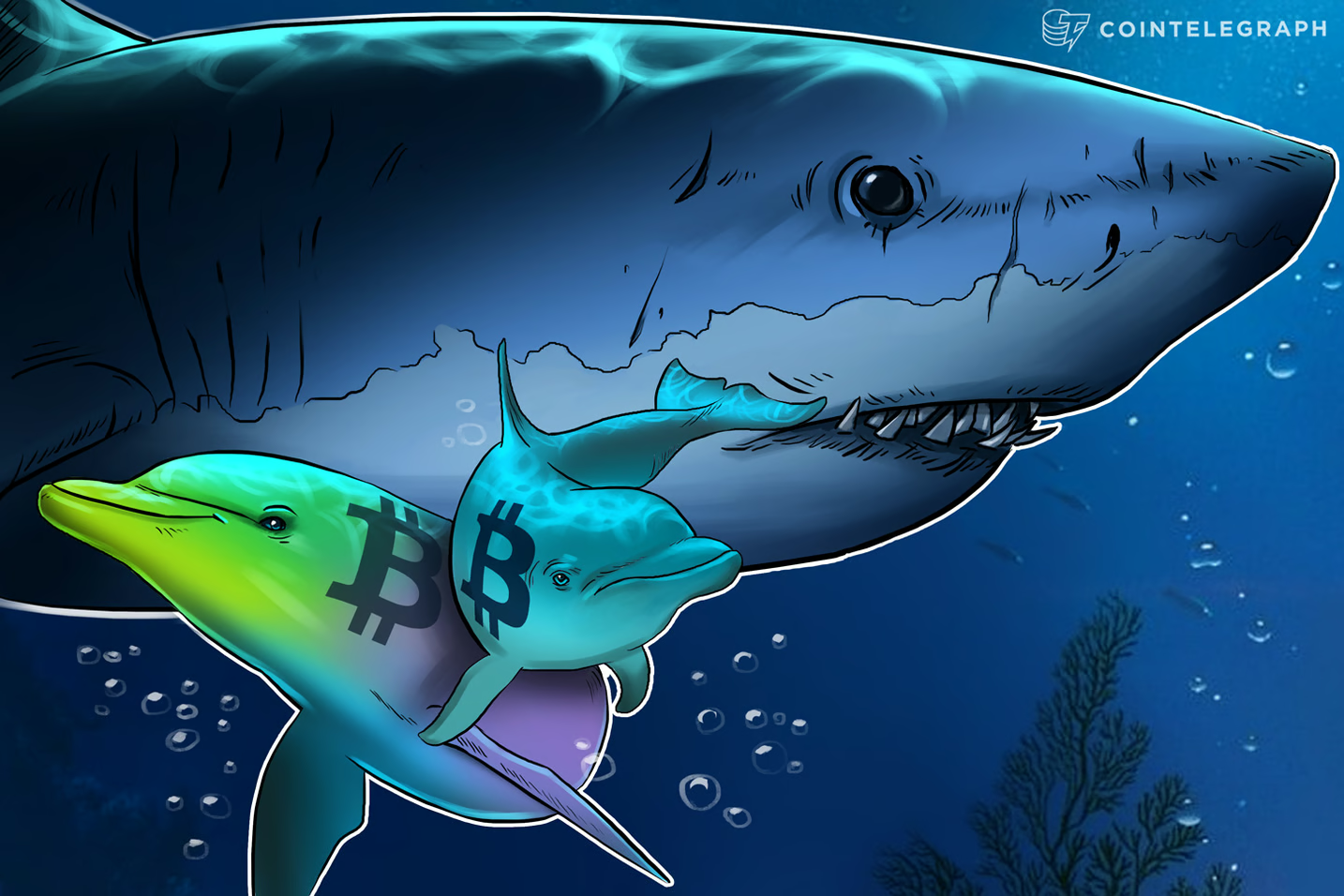

Bitcoin Sharks and Whales Remain Unshaken Despite the Market Dip: What This Means for You

Bitcoin has been on a rollercoaster, and you may have felt the pinch when prices dipped under $60,000. But here’s the kicker: while the market appeared shaky, sharks and whales—the big players in the crypto world—are holding steady and even buying more Bitcoin. These key players, holding anywhere between 10 and 10,000 BTC, aren’t fazed by the recent volatility. In fact, data shows they’ve added a massive 133,300 Bitcoin to their portfolios over the past month. Why should this matter to you? Let’s dive deeper.

Sharks and whales are influential figures in the market. Their behavior often serves as a signal for the rest of us. When these major holders start accumulating Bitcoin during a downturn, it sends a strong message: they have confidence in the long-term value of BTC, despite the short-term dips. On-chain analytics from Santiment show that while smaller investors are panic-selling, these large holders are scooping up Bitcoin.

It’s hard not to get emotional when prices swing this much, but seeing these whales holding firm should bring some peace of mind. They’re in this for the long game. Are you?

As a trader, this insight could guide your strategy. Should you follow the sharks and whales by continuing to hold or even buy during a dip? This might be the time to rethink panic selling, especially if the big players aren’t jumping ship.

In the meantime, if you’re feeling a bit anxious, you’re not alone. Watching the market crash is always tough, but seeing these whales continuing to accumulate may remind you that short-term dips don’t mean the end of Bitcoin. Remember, these whales didn’t become whales by making rash decisions—they play the long game, and so should you.

At the moment, Bitcoin’s price hovers around $60,100. While that may feel low to some, it’s important to recognize that these dips are often part of the market cycle. The question is: are you ready to hold steady like the whales, or will you let fear drive your next move?